Kuwait’s oil price experienced a modest decline, settling at $75.93 per barrel on Thursday, February 27, 2025. This 56-cent decrease from the previous day’s price of $76.49 was reported by the Kuwait Petroleum Corporation (KPC) on Friday.

In contrast, global oil benchmarks saw an upward trend. Brent crude oil rose by $1.51, reaching $74.04 per barrel, while West Texas Intermediate (WTI) increased by $1.73, settling at $70.35 per barrel. The decline in Kuwaiti crude prices comes amid continued fluctuations in the international energy market, which have been influenced by several global economic and geopolitical factors.

Recent Trends in Kuwaiti Oil Prices

The recent decrease follows a series of fluctuations in Kuwait’s oil prices over the past week:

- February 26, 2025: Price dropped by $1.33, settling at $76.49 per barrel.

- February 24, 2025: Price decreased by $1.90, reaching $77.25 per barrel.

These variations reflect the dynamic nature of the global oil market, influenced by factors such as supply-demand balances, geopolitical events, and economic indicators.

Over the past few months, Kuwait’s oil prices have fluctuated due to market adjustments, external economic pressures, and global events that have shaped the demand and supply of crude oil. The decrease in price, while relatively modest, raises concerns about the long-term stability of oil prices in Kuwait and its potential impact on the country’s economy.

Global Market Influences

The global oil market has been experiencing volatility due to several factors:

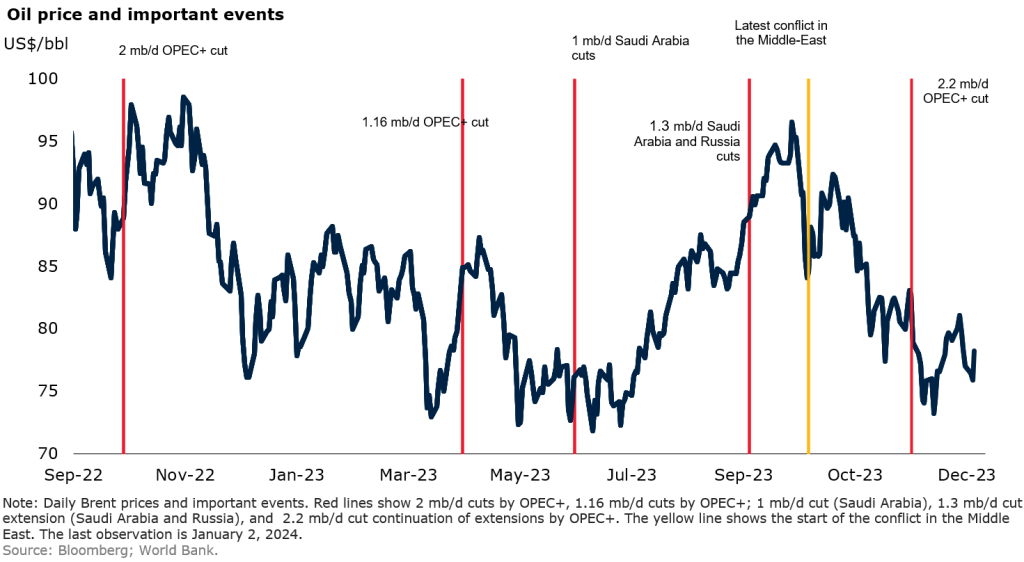

- OPEC+ Production Cuts: In November 2024, OPEC and its allied oil-producing nations extended their output cuts by an additional month, now lasting until the end of December 2024. This decision aimed to stabilize prices amid fluctuating demand. Kuwait, as a member of OPEC, has aligned its production strategy with the broader objectives of the alliance. Production adjustments within OPEC+ play a significant role in influencing crude oil prices, impacting Kuwait’s revenue and economic stability.

- Economic Indicators: Concerns over global economic growth, especially in major economies such as the United States, China, and the European Union, have led to adjustments in oil demand forecasts, impacting prices. Economic downturns tend to reduce oil consumption, leading to price declines, whereas economic recoveries push prices upward.

- Geopolitical Tensions: Ongoing geopolitical events, particularly in oil-rich regions such as the Middle East and Eastern Europe, continue to introduce uncertainty into the market. Conflicts, sanctions, and policy changes in key oil-producing countries affect supply chains and investor confidence, leading to price fluctuations.

- US Dollar Strength and Interest Rates: Since oil is traded in US dollars, the strength of the dollar against other currencies influences oil prices. A stronger dollar makes oil more expensive for countries using other currencies, potentially reducing demand. Interest rate hikes by the US Federal Reserve and other central banks also impact global economic activity and, subsequently, oil demand.

Implications for Kuwait

As a member of OPEC and a significant oil exporter, Kuwait’s economy is closely tied to oil revenues. Fluctuations in oil prices can have direct implications for the nation’s fiscal budget, public spending, and economic planning. The recent price movements underscore the importance of strategic planning and diversification efforts to mitigate the impacts of global market volatility.

Kuwait heavily depends on oil exports, with petroleum accounting for nearly 90% of government revenue. A prolonged decline in prices can lead to budget deficits, prompting the government to reconsider its fiscal policies, including subsidies, public sector wages, and infrastructure investments. Lower oil prices may also impact foreign investments in the country’s energy sector, as investors seek higher returns in more stable markets.

To address these challenges, Kuwait has been working toward economic diversification, with initiatives such as Vision 2035 aimed at reducing reliance on oil. Investments in non-oil sectors, including finance, tourism, and manufacturing, are crucial to ensuring economic stability amid fluctuating oil revenues.

Looking Ahead

Market analysts will be monitoring several factors that could influence oil prices in the near future:

- OPEC+ Policy Decisions: Any changes in production quotas or extensions of existing cuts will play a crucial role in balancing supply and demand. OPEC+ members, including Kuwait, will need to navigate production strategies carefully to maintain price stability while ensuring adequate revenue generation.

- Global Economic Performance: Indicators of economic health in major consumer countries, such as GDP growth rates, industrial output, and inflation trends, will affect oil demand projections. Economic slowdowns in large economies could lead to reduced energy consumption and downward pressure on prices.

- Technological Advancements: Developments in alternative energy sources and improvements in energy efficiency could alter long-term demand for oil. The rise of electric vehicles, renewable energy projects, and sustainable energy policies in key consumer markets could impact future demand for fossil fuels, influencing Kuwait’s long-term economic strategies.

- Geopolitical Developments: Political instability in oil-producing regions, trade policies, and international sanctions on key oil producers will remain critical factors to watch. Any major disruption in oil supply due to conflicts or diplomatic tensions could lead to price spikes, affecting Kuwait’s oil exports and revenue projections.

Despite the recent decline in Kuwait’s oil prices, industry experts believe that the market will remain volatile, with prices subject to fluctuations based on these critical global factors. Kuwait’s ability to adapt to changing market dynamics and implement long-term economic diversification strategies will be essential in ensuring economic stability and growth in the coming years.

Conclusion

Kuwait’s oil price drop to $75.93 per barrel reflects the broader volatility in the global energy market. While the decrease of 56 cents may seem minor, it signals ongoing market challenges influenced by economic, geopolitical, and policy-driven factors. Kuwait, like other oil-producing nations, must carefully navigate these fluctuations to maintain economic stability and ensure a resilient future. As the world shifts toward more sustainable energy solutions, Kuwait’s strategic planning and economic diversification efforts will be critical in securing long-term financial and economic health.

Blatter Criticizes FIFA’s World Cup Hosting Decisions: England Overlooked, Saudi Arabia Selected