Doha, Qatar – Qatar National Cement Company (QNCC) has reported a net profit of QAR 160 million (approximately US$44 million) for the fiscal year ending December 31, 2024. This marks a decline from the previous year’s profit of QAR 205 million. The decrease reflects the challenges faced by the construction and cement sectors, including reduced demand and increased production costs. Despite these obstacles, QNCC managed to remain profitable, showcasing its resilience and ability to adapt through effective cost management and strategic initiatives.

Financial Performance and Analysis

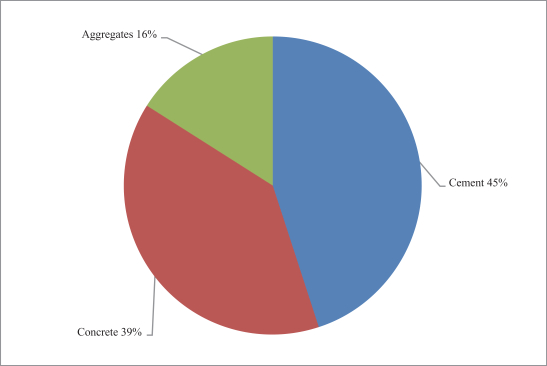

The company’s revenue for 2024 was QAR 397 million, a 13.8% drop compared to QAR 460.7 million in 2023. This downturn is largely attributed to a noticeable decrease in demand for core products, including cement and washed sand. The construction sector in Qatar experienced a slowdown, influenced by macroeconomic factors and the completion of major infrastructure projects post-World Cup 2022. This, coupled with increased competition and rising energy costs, pressured QNCC’s financial performance.

The gross profit margin also saw a decline due to higher production costs, primarily driven by energy prices and logistics expenses. However, the company’s strategic focus on cost optimization helped mitigate the impact to some extent. Measures included improving operational efficiencies, renegotiating supplier contracts, and enhancing energy usage practices. Additionally, deposit income saw a substantial rise of 37%, providing a buffer to the declining core revenues.

Dividend Declaration and Shareholder Confidence

In response to the financial results, QNCC’s Board of Directors has recommended a 27% cash dividend for 2024, equivalent to QAR 0.27 per share. This proposal reflects the management’s confidence in the company’s ability to generate sustainable returns for shareholders despite current market challenges. The dividend distribution is scheduled for approval during the General Assembly meeting set for February 17, 2025, at the Century Marina Hotel in Lusail. This move is seen as an effort to maintain investor confidence and reward shareholders for their continued support.

The decision to maintain a robust dividend payout highlights QNCC’s financial stability and prudent management practices. By balancing dividend distribution with investment in strategic projects, the company aims to support both short-term returns and long-term growth.

Strategic Initiatives for Growth

QNCC has outlined a series of strategic initiatives to strengthen its market position and enhance financial performance in the coming years:

- Product Diversification:

The company is expanding its product portfolio to include oil well cement, which is in demand by the regional oil and gas sectors. By diversifying its offerings, QNCC aims to reduce dependency on traditional cement products and tap into new revenue streams. - Cost Optimization:

QNCC is actively pursuing cost reduction strategies, focusing on optimizing energy consumption and improving operational efficiencies. These efforts are crucial for sustaining profitability, especially in a competitive market with fluctuating raw material and energy prices. - Sustainable Energy Initiatives:

As part of its sustainability agenda, QNCC plans to incorporate alternative fuels into its production processes. This includes utilizing waste and household materials as fuel for cement kilns at the Umm Bab facility. This initiative is expected to lower energy costs and reduce the company’s carbon footprint, aligning with Qatar National Vision 2030. - Infrastructure and Facility Expansion:

The company is progressing with multiple projects, such as utilizing leased land in the industrial area and connecting its facilities to the public water network. Additionally, QNCC is developing its allocated land in Mesaieed Industrial City to expand production capabilities. - Revenue Diversification:

QNCC is exploring investment opportunities both within Qatar and internationally. This approach is aimed at reducing reliance on local markets and mitigating risks associated with market volatility.

Challenges and Market Conditions

The Qatari cement industry is currently navigating a challenging landscape, marked by oversupply, increased competition, and fluctuating demand. The completion of major infrastructure projects and reduced construction activity have led to a surplus of cement in the market, exerting downward pressure on prices. Additionally, rising energy costs have significantly impacted production expenses.

QNCC’s strategic focus on cost management and operational efficiency has helped it withstand some of these pressures. However, the company acknowledges that market conditions are likely to remain challenging in the near term. In response, QNCC is prioritizing efficiency improvements, diversification, and exploring export opportunities to neighboring countries.

Management Commentary

Engineer Essa Mohammed Ali Kaldari, CEO of QNCC, emphasized the company’s commitment to sustainable growth and operational excellence. He highlighted that the ability to maintain profitability despite declining revenues reflects the effectiveness of QNCC’s strategic initiatives. According to Kaldari, the focus on cost optimization, product diversification, and energy efficiency will be key to navigating market challenges and sustaining profitability.

The CEO also reiterated the company’s dedication to aligning its operations with Qatar National Vision 2030, focusing on sustainability, innovation, and economic diversification. This includes adopting best practices in environmental management, reducing emissions, and investing in technologies that enhance production efficiency.

Commitment to Sustainability and Governance

QNCC has reaffirmed its commitment to enhancing health, safety, and environmental standards across its operations. This includes investing in new technologies to reduce emissions and energy consumption, as well as improving social services for workers. The company’s sustainability initiatives are designed to comply with local and international standards, demonstrating a proactive approach to corporate governance.

Additionally, QNCC continues to support community and sports activities as part of its corporate social responsibility initiatives. These efforts are aligned with the broader goals of Qatar National Vision 2030, which emphasizes sustainable development and environmental stewardship.

Future Outlook

Looking ahead, QNCC remains cautiously optimistic about its growth prospects. The company is banking on strategic investments, product diversification, and enhanced operational efficiencies to drive growth. The focus on alternative energy sources and sustainable practices is expected to yield long-term benefits, reducing costs and enhancing competitiveness.

The management’s emphasis on exploring new markets outside Qatar also presents an opportunity for revenue diversification. By expanding its footprint in the regional market, QNCC aims to reduce its dependence on the domestic construction sector, which has shown signs of slowing down.

Furthermore, the planned introduction of new products, such as oil well cement, is expected to open up new revenue streams, particularly in the oil and gas sector. The company’s ability to innovate and adapt to changing market dynamics will be crucial in achieving its long-term objectives.

Conclusion

Despite a challenging year marked by declining demand and rising costs, Qatar National Cement Company has demonstrated resilience through strategic cost management, product diversification, and sustainability initiatives. The company’s ability to maintain profitability and propose a significant dividend payout underscores its financial stability and prudent management practices.

As QNCC moves forward, its focus on efficiency, sustainability, and revenue diversification will be critical to navigating the evolving market landscape. The company’s strategic initiatives, coupled with a strong governance framework, position it well to capitalize on emerging opportunities and sustain long-term growth.

With a clear strategy and commitment to sustainable practices, QNCC is poised to overcome current challenges and continue contributing to Qatar’s economic development and diversification goals.

Former Indian Navy Officials Released from Qatari Prison: A Diplomatic Victory