Kuwait’s New Public Debt Law: Paving the Way for Economic Diversification and Growth

Kuwait has taken a significant step towards bolstering its economic framework by enacting the Public Debt Law, officially known as the Financing and Liquidity Law. This landmark legislation authorizes the government to issue up to 20 billion Kuwaiti dinars (approximately $65 billion) in sovereign bonds and Islamic Sukuk over the next 50 years. The move aims to address liquidity challenges, finance infrastructure projects, and reduce the nation’s reliance on oil revenues. This decision marks a pivotal moment in Kuwait’s economic history, signifying a strategic shift towards financial sustainability and resilience.

Key Provisions of the Public Debt Law

The newly approved law establishes a structured framework for public borrowing, allowing Kuwait to access international debt markets with clearly defined limits and conditions. The legislation permits the issuance of financial instruments with maturities of up to 50 years, providing the government with flexibility in managing its debt portfolio. Additionally, the law introduces a debt-to-GDP ceiling of 60 percent, ensuring sustainable borrowing practices and maintaining fiscal discipline.

By implementing a structured debt strategy, the government aims to prevent financial mismanagement and avoid excessive reliance on emergency liquidity measures. The ability to issue bonds and Sukuk with extended maturity periods allows for better long-term planning, particularly for infrastructure development and economic diversification efforts.

Economic Rationale Behind the Legislation

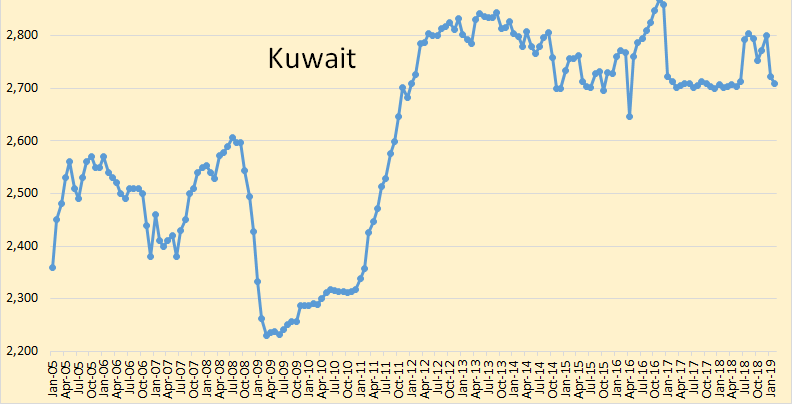

Historically, Kuwait has relied heavily on oil revenues and the General Reserve Fund (GRF) to finance public spending. However, fluctuations in oil prices and increasing government expenditures have led to fiscal imbalances. The absence of a borrowing framework since the expiration of the previous debt law in 2017 resulted in the depletion of the GRF, especially following the economic strains imposed by the COVID-19 pandemic.

The introduction of the Public Debt Law signifies a strategic shift towards structured debt management, aiming to diversify funding sources and enhance fiscal sustainability. Rather than depleting reserves to finance projects, the government now has the ability to raise capital through global debt markets, ensuring greater financial stability in the long run.

Implications for Infrastructure Development

The enactment of the debt law is poised to unlock substantial funding for infrastructure projects. The draft budget for the fiscal year 2025-2026 includes approximately 373 projects valued at around 12.8 billion dinars ($42.2 billion). Notable initiatives encompass the development of a second terminal at Kuwait International Airport and the expansion of Mubarak Al-Kabeer Port, which is set to become one of the largest ports in the Middle East. These projects are integral to Kuwait’s Vision 2035, which aims to transform the nation into a regional financial and commercial hub.

With improved access to capital, the government can accelerate the completion of long-term infrastructure plans, including transportation, energy, and public utilities. Investments in these areas are expected to create job opportunities, stimulate private sector growth, and attract foreign direct investment (FDI), further solidifying Kuwait’s position in the global economy.

Market Response and Investor Confidence

The passage of the Public Debt Law has been met with positive reactions from financial markets and investors. JPMorgan Chase & Co. has reclassified Kuwait from an emerging to a developed market, initiating its removal from the Emerging Markets Bond Index (EMBI) starting March 31, 2025, over a six-month period. This reclassification reflects Kuwait’s economic evolution and commitment to financial reforms, positioning the nation for increased foreign investment and long-term growth.

Investor confidence in Kuwait’s economy is likely to rise due to the clear borrowing framework and enhanced fiscal management. International investors seeking stable markets with structured debt policies will find Kuwait’s sovereign bonds and Sukuk more attractive, leading to greater inflows of capital.

Challenges and Considerations

While the Public Debt Law marks a pivotal advancement, its successful implementation hinges on several factors. Ensuring transparency in the utilization of borrowed funds, adhering to the stipulated debt-to-GDP ceiling, and effectively managing repayment obligations are critical to maintaining fiscal health. Moreover, fostering a conducive environment for private sector participation in infrastructure projects will be essential to achieve the desired economic diversification.

A key challenge will be maintaining fiscal discipline and preventing excessive reliance on borrowed capital. The government must also ensure that funds raised through debt issuance are allocated effectively to projects that generate long-term economic benefits. Clear governance mechanisms, oversight committees, and financial reporting will play a crucial role in ensuring accountability and efficiency.

Additionally, global economic conditions and interest rate fluctuations could impact Kuwait’s ability to secure favorable borrowing terms. The government must carefully monitor international financial markets to optimize borrowing strategies and mitigate potential risks associated with external debt obligations.

Conclusion

Kuwait’s enactment of the Public Debt Law represents a strategic move towards enhancing its economic resilience and reducing dependency on oil revenues. By establishing a structured framework for public borrowing, the nation is better positioned to finance vital infrastructure projects, stimulate economic growth, and attract foreign investment. As Kuwait embarks on this new fiscal trajectory, prudent implementation and adherence to fiscal discipline will be paramount to realizing the long-term benefits of this legislation.

The law serves as a foundation for economic diversification, ensuring that future generations benefit from a more sustainable and robust economy. With careful execution, Kuwait can leverage this new financial framework to strengthen its global economic standing while fostering domestic prosperity. The coming years will be crucial in determining how effectively the nation can capitalize on this opportunity to build a stronger, more resilient economy.

Do follow gulf magazine on Instagram

for more information click here