The Kuwait stock market, known as Boursa Kuwait, ended Sunday’s trading session in the red, reflecting a sharp drop across its major indices. Investors reacted nervously to growing global economic uncertainty, sending stock prices tumbling amid rising geopolitical tensions and falling oil prices.

The All-Share Index dropped by 5.16%, losing 412.84 points to close at 7,587.89. This marks one of the steepest single-day declines in recent months. The Premier Market Index, which includes the biggest listed companies in the country, recorded an even sharper fall, down by 5.69%, shedding 488.79 points to close at 8,106.08. The Main Market Index, which covers smaller and mid-sized stocks, also declined by 2.67%, or 192.66 points, ending the session at 7,013.23.

This sharp downturn came as no surprise to market watchers, who had been predicting turbulence in the region’s financial markets due to a growing list of external pressures. Chief among them is the escalating trade war between the United States and China, which has had ripple effects across global economies.

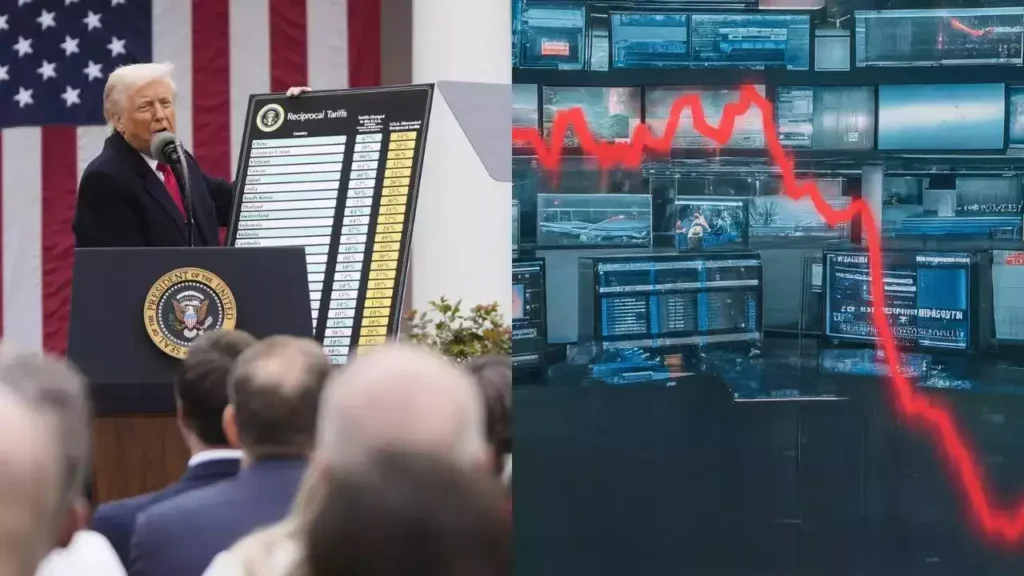

Trade War Escalation Fuels Investor Anxiety

The global economic environment has grown increasingly uncertain as trade tensions between the U.S. and China intensify. In a recent move, the U.S. government imposed a new round of sweeping tariffs on Chinese goods, escalating the trade war that has dragged on for several years. China responded by announcing a 34% tariff on a broad range of U.S. imports, set to take effect on April 10.

This tit-for-tat trade strategy is causing growing concern among investors worldwide, who fear that prolonged hostilities between the two superpowers could push the global economy closer to a recession. These fears were reflected not just in Kuwait, but across Gulf markets, as the rising uncertainty weighed heavily on investor sentiment.

Economists warn that the Gulf Cooperation Council (GCC) nations, including Kuwait, are especially vulnerable to shocks caused by global trade disruptions. Most of these countries depend heavily on oil exports and foreign trade, and any global economic slowdown could directly affect their national revenues, budgets, and development plans.

Falling Oil Prices Add to Market Pressure

In addition to the global trade tensions, another major factor dragging down Kuwait’s market is the steep drop in oil prices. Oil, which is the backbone of Kuwait’s economy, saw a sharp 7% decline over the past week, hitting a three-year low.

The plunge in oil prices has been driven by several factors. First, the global demand for crude has softened due to fears of a slowdown in international trade and manufacturing. Second, there has been a surprising increase in oil production from several OPEC+ countries, including Russia and some Gulf states. This oversupply has pushed prices down, despite earlier efforts to stabilize the market through production cuts.

For Kuwait, where oil exports account for a large share of government revenue and economic output, this price decline is especially concerning. The country may face increased fiscal pressure in the months ahead, particularly if oil prices remain low or fall further. Market analysts suggest that the government could be forced to revisit its spending plans or consider austerity measures to balance the budget if the current trend continues.

Regional Markets Join in the Downturn

The decline in Boursa Kuwait was not an isolated event. Stock exchanges across the Middle East and North Africa (MENA) region also suffered losses during the same trading day. Saudi Arabia’s Tadawul stock exchange, the largest in the region, saw its benchmark index fall by 6.8%, marking its worst day since the height of the COVID-19 pandemic in May 2020.

Qatar’s index dropped by 4.2% after returning from the Eid al-Fitr holiday, while Egypt’s EGX30 index closed down by 3.3%. Other GCC markets, such as Bahrain, Oman, and the UAE, also recorded losses, further highlighting the shared economic vulnerability among Gulf states.

Market observers believe the synchronized decline across the region is a clear sign that external pressures are beginning to weigh more heavily on investor confidence. The combination of trade conflicts, currency volatility, and falling energy prices is proving difficult for regional markets to absorb.

Local Market Activity and Sector Analysis

Within Boursa Kuwait, the decline was widespread, affecting nearly all sectors. Blue-chip companies in banking, telecommunications, and energy were among the hardest hit, with some losing over 6% in a single session.

Banking stocks, which make up a significant portion of the Premier Market Index, dropped sharply as investors feared the potential impact of slowing economic activity and lower consumer spending. Shares of major banks like the National Bank of Kuwait and Kuwait Finance House recorded significant losses.

Telecommunications companies also struggled, weighed down by concerns over rising costs, shrinking margins, and declining customer activity. Meanwhile, energy-related stocks fell in line with international oil trends.

Even traditionally stable sectors like consumer goods and services failed to buck the trend, as panic selling overtook the broader market.

Outlook: What’s Next for Boursa Kuwait?

The road ahead remains uncertain for Boursa Kuwait and the wider regional markets. Much will depend on how quickly global tensions can be eased and whether oil prices will stabilize in the near future. Analysts believe that volatility is likely to remain high in the short term, especially if the U.S.-China trade war continues to escalate or spreads into other sectors like technology and finance.

Domestically, Kuwait’s government may consider intervening to support the market through economic stimulus or by encouraging institutional investment. The central bank could also play a role by adjusting interest rates or providing liquidity support to stabilize financial institutions.

For investors, the key will be to stay calm and avoid panic-driven decisions. Financial advisors recommend focusing on long-term investment strategies and diversifying portfolios to manage risk during uncertain times.

Conclusion

Sunday’s sharp losses on Boursa Kuwait reflect a complex and challenging global environment. The country’s stock market has been caught in the crossfire of a global trade war, falling oil prices, and regional economic pressures. As global markets remain under strain, investors and policymakers in Kuwait will need to carefully navigate the weeks ahead.

While the current situation may seem bleak, history shows that markets are resilient. With strategic planning, policy support, and international cooperation, there is hope that both Kuwait and the broader GCC can weather this storm and return to stability in the months to come.

Baker Hughes Marks Major Milestone in Saudi Arabia with Dammam Facility Expansion