Saudi Arabia and UAE market trends have been gaining international attention due to their diverging trajectories in 2025. Once closely aligned in their economic strategies and market dynamics, Saudi Arabia and the United Arab Emirates are now moving in different directions. These shifts are shaping investment flows, policy decisions, and long-term growth prospects in the region. From trade to tourism and technology, the gap between these two Gulf giants is becoming more evident.

This article highlights seven major differences between the two markets, their implications, and why understanding these shifts is critical for businesses and investors across the globe.

Economic Growth Patterns: A Tale of Two Visions

In 2025, Saudi Arabia is focusing heavily on its Vision 2030 goals, resulting in massive public spending and infrastructure investment. Mega-projects like Neom City, the Red Sea Project, and large-scale privatizations are fueling domestic demand and driving non-oil growth.

In contrast, the UAE especially Dubai and Abu Dhabi is adopting a more balanced, diversified economic model. The UAE is targeting sustainable growth through digital innovation, green energy, and expanding global partnerships. This cautious yet steady approach offers stability but may limit short-term growth spurts compared to Saudi Arabia’s high-velocity expansion.

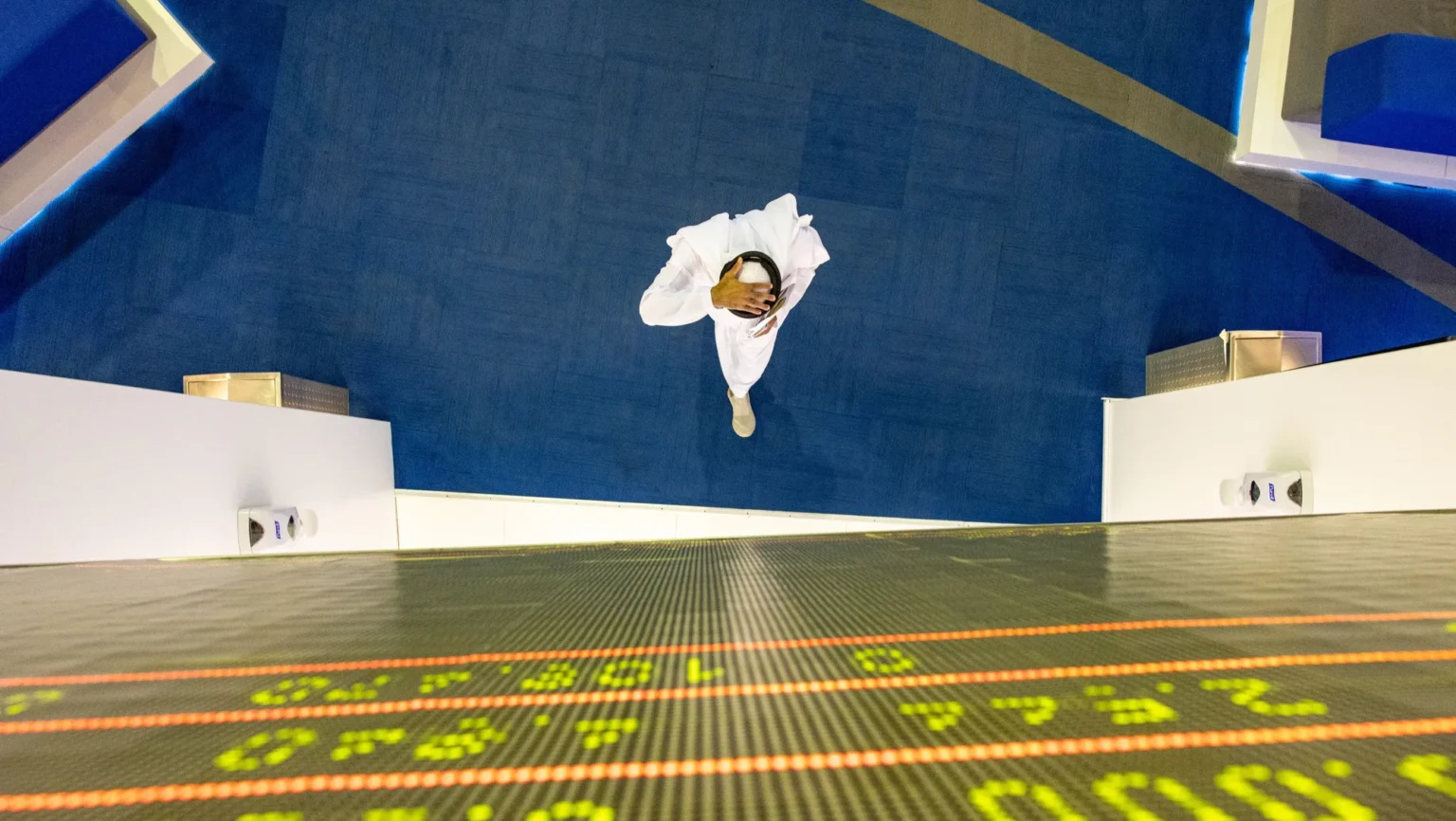

Stock Market Performance: Bull vs Stability

Saudi Arabia’s Tadawul Stock Exchange has seen strong performance, driven by investor confidence in Vision 2030, government-backed projects, and rising foreign investment. Sectors like construction, energy, and tourism are seeing bullish momentum.

Meanwhile, the Abu Dhabi Securities Exchange (ADX) and Dubai Financial Market (DFM) have shown more stability with modest growth. While tech and logistics sectors have risen, UAE investors remain cautious due to global headwinds and local regulatory reforms. This difference in stock market activity reflects the broader economic sentiments of each nation.

Oil Dependency vs Diversification

One of the main drivers of these diverging Saudi Arabia and UAE market trends is oil dependency. Saudi Arabia still leans heavily on oil revenues despite efforts to diversify. Though oil prices remain resilient, the country’s economy is highly sensitive to global fluctuations in oil demand.

The UAE, on the other hand, has made more progress in reducing its oil dependence. It now generates a significant portion of its GDP from tourism, aviation, logistics, and financial services. This diversification makes the UAE less vulnerable to oil price shocks, giving it a strategic advantage in long-term sustainability.

Foreign Investment Strategies: Aggressive vs Strategic

Saudi Arabia is actively pursuing aggressive foreign investment through its Public Investment Fund (PIF), which is investing in international sports, tech, and tourism assets. The Kingdom is also opening up more sectors to 100% foreign ownership to attract FDI.

The UAE is taking a more calculated approach by offering golden visas, attracting global talent, and enhancing business regulations. Free zones and stable infrastructure continue to attract startups and multinational corporations. While both nations aim to increase foreign inflows, their methods and risk levels vary significantly.

Labor Market Reforms and Talent Retention

Saudi Arabia is in the midst of reforming its labor laws to reduce its dependence on foreign workers and increase local employment. Programs like Saudization are helping citizens secure private sector jobs, but businesses face challenges adjusting to the new talent dynamics.

In contrast, the UAE has become more expat-friendly, easing visa rules and offering long-term residency. Its global workforce remains diverse and steady. As a result, UAE companies benefit from access to a broad talent pool, giving them an edge in innovation and service delivery.

Tourism and Real Estate Trends

Tourism is booming in both countries, but the Saudi Arabia and UAE market trends show key differences. Saudi Arabia’s tourism is still in its early stages, with attractions like AlUla, Diriyah, and The Line drawing international curiosity. Heavy marketing and investments aim to transform the Kingdom into a global destination by 2030.

The UAE, especially Dubai, continues to thrive as a well-established tourist hotspot. With world-class infrastructure, luxury hotels, and consistent branding, Dubai attracts millions yearly. Real estate in Dubai remains investor-friendly, while Saudi’s property market is evolving and still finding its balance.

Tech and Digital Transformation Initiatives

Both countries are pushing digital transformation, but again, strategies differ. Saudi Arabia is investing heavily in smart city projects, AI integration, and fintech through government support and partnerships. However, implementation remains in early stages.

The UAE is ahead in execution. Dubai has become a tech hub, with initiatives like Dubai Internet City, blockchain adoption, and paperless government systems. UAE’s early-mover advantage in tech adoption strengthens its innovation ecosystem.

Challenges and Global Risks

Despite their achievements, both countries face challenges. Saudi Arabia’s high-speed growth comes with risks rising public debt, implementation delays, and over-reliance on oil-backed spending. Investors may find the pace overwhelming and subject to reversals if global conditions shift.

The UAE faces geopolitical tensions, competition from regional markets, and the need to maintain investor confidence amid global economic uncertainties. But its risk profile is relatively lower due to economic diversification and mature market practices.

Investor Takeaway: What the Divergence Means for You

For global investors and businesses, these diverging Saudi Arabia and UAE market trends present unique opportunities and challenges. Saudi Arabia offers high returns but with higher risk, especially for those aligned with national goals and infrastructure projects.

The UAE presents lower risk, moderate returns, and stable entry into the Middle East market. Its mature business environment, regulatory clarity, and international connectivity make it a safe haven for long-term investments.

Understanding these differences allows investors to allocate resources wisely, depending on their appetite for risk and growth potential.

Conclusion: Different Roads, Shared Ambitions

Though Saudi Arabia and the UAE are diverging in their market strategies, they share a common ambition to lead the Middle East into a new era of prosperity. Each has chosen a different path, shaped by internal goals, global positioning, and investor expectations.

Whether you’re a business leader, policymaker, or investor, keeping a close eye on Saudi Arabia and UAE market trends is essential. These nations will continue to influence global markets in ways we are only beginning to understand. The future lies not in comparing who does it better, but in appreciating how both contribute to reshaping the region.

Do follow Gulf Magazine on Instagram

Also Read – Google Maps Blocks Gulf of America Reviews: 5 Shocking Reasons