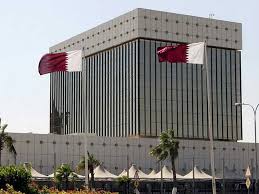

Qatar Central Bank ATM POS network disruption has caused a temporary halt in debit card transactions across ATMs and POS terminals not affiliated with the card-issuing bank. The disruption highlighted the growing reliance of Qatar’s residents and businesses on the national electronic payment system. While the outage lasted for only a few hours, it underscored the importance of resilient banking infrastructure and multiple payment alternatives.

What Caused the Disruption?

The exact cause of the technical issue was not disclosed by the QCB. However, the bank’s specialized technical teams acted promptly to identify and resolve the problem. Within approximately two hours, all affected services were restored, and normal operations resumed.

Which Services Were Affected?

The disruption primarily impacted debit card transactions at ATMs and POS terminals not affiliated with the card-issuing bank. Customers attempting to withdraw cash or make purchases using their debit cards at unaffiliated devices experienced difficulties during the outage.

Importantly, other payment services were not affected by the disruption. Credit card transactions continued to operate normally, and the Fawran instant payment service remained unaffected. These alternative payment solutions provided customers with continued access to financial services during the incident.

How Did the QCB Respond?

Upon detecting the technical issue, the QCB’s specialized technical teams took immediate action to address the problem. Their swift response ensured that the disruption was resolved promptly, minimizing the impact on customers.

The QCB emphasized its commitment to maintaining the continuity and efficiency of banking services in Qatar. The bank’s proactive approach in resolving the issue reflects its dedication to ensuring the quality of financial operations without interruption.

Customer Experience During the Qatar Central Bank ATM POS Network Disruption

Qatar Central Bank ATM POS network disruption provided a clear example of how crucial digital payment infrastructure has become in everyday life. For many residents and visitors in Qatar, debit cards are the primary method of accessing cash or completing purchases. The temporary halt in service at ATMs and POS terminals not affiliated with the card-issuing bank highlighted how reliant people have become on interconnected banking networks.

During the disruption, some customers reported minor inconveniences, such as being unable to complete grocery purchases or withdraw cash at certain ATMs. However, those using credit cards or the Fawran instant payment service were largely unaffected. This scenario reinforced the importance of having multiple financial tools available, as they can mitigate the impact of technical issues on daily transactions.

The Growing Importance of Digital Payment Systems

Digital payment systems have grown exponentially in Qatar over the past decade, driven by technological advancements and government initiatives promoting cashless transactions. The recent disruption demonstrates that while these systems provide convenience and speed, they also require robust safeguards and continuous monitoring to ensure reliability.

QCB’s handling of the incident reflects a proactive approach to maintaining trust in the nation’s financial network. By swiftly addressing the problem and restoring services, the bank minimized potential panic or economic disruption, reinforcing confidence in Qatar’s banking system.

Measures to Strengthen Network Resilience

While the QCB did not release detailed future strategies, financial experts suggest that continuous investment in monitoring tools, system redundancy, and disaster recovery plans are essential for minimizing risks. Ensuring that all ATMs and POS devices are equipped with backup systems can help maintain service even during unexpected technical disruptions.

The recent incident also provides an opportunity for banks to educate customers about alternative payment options and to encourage the adoption of mobile wallets and instant payment solutions. Diversifying payment methods strengthens both consumer convenience and overall network resilience.

Ensuring Financial Stability in the Digital Era

The Qatar Central Bank ATM POS network disruption serves as a reminder of the delicate balance between technology and financial services. While occasional glitches are inevitable, the ability of the central bank to respond quickly and effectively protects consumers and businesses alike.

As Qatar continues to modernize its financial infrastructure and embrace digital payment technologies, incidents like this highlight the need for continuous innovation, vigilant monitoring, and proactive customer communication to ensure seamless and secure financial services.

What Does This Mean for Customers?

For most customers, the disruption had a minimal impact, as alternative payment methods such as credit cards and the Fawran instant payment service remained operational. However, those who rely solely on debit cards for transactions at unaffiliated ATMs and POS terminals experienced temporary inconvenience.

The QCB’s prompt resolution of the issue underscores the importance of having multiple payment options available. Customers are encouraged to utilize credit cards or the Fawran service during such outages to ensure uninterrupted access to their funds.

Looking Ahead

The QCB has not provided specific details on measures to prevent similar disruptions in the future. However, the bank’s swift response to the recent issue indicates a commitment to enhancing the resilience of the NAPS network.

As digital payment systems continue to play a crucial role in daily transactions, it is essential for financial institutions to invest in robust infrastructure and proactive monitoring to minimize the risk of service disruptions.

In conclusion, while the recent disruption in Qatar’s ATM and POS network was unfortunate, the QCB’s prompt action in resolving the issue demonstrates the bank’s commitment to maintaining a stable and efficient financial system. Customers are encouraged to stay informed about alternative payment options to ensure seamless transactions during unforeseen outages.

Do follow us: Instagram

Read More: Qatar’s National Sports Day 2025: A Celebration of Fitness and Unity