Saudi oil giant Aramco has announced a strategic partnership with Ma’aden, the Kingdom’s leading mining company, to form a joint venture (JV) focused on lithium extraction and processing. This major step marks Saudi Arabia’s entry into the global lithium market, a critical mineral for electric vehicle (EV) batteries and renewable energy storage. The move aligns with the nation’s ambitious Vision 2030 strategy, which aims to diversify the economy away from oil dependence and establish Saudi Arabia as a key player in the global energy transition.

Saudi Arabia’s Vision for Lithium

The Kingdom is accelerating its efforts to explore new economic opportunities, with lithium emerging as a crucial mineral for the future. Often referred to as “white gold,” lithium is essential for the production of rechargeable batteries used in electric vehicles, consumer electronics, and energy storage systems. As global demand for EVs and clean energy solutions continues to rise, securing a reliable and sustainable supply of lithium has become a top priority for many nations.

By tapping into its own lithium resources, Saudi Arabia aims to establish itself as a major lithium supplier and reduce dependence on imports. The Kingdom’s strong financial backing and industrial expertise put it in a favorable position to compete in the international market. The government has also been actively encouraging partnerships with international firms to help develop and commercialize its mineral resources.

Aramco and Ma’aden: A Powerful Alliance

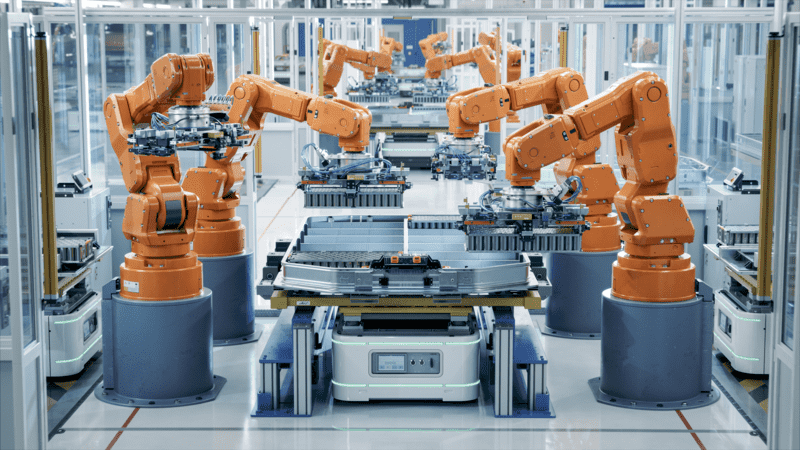

Aramco, primarily known for its dominance in the oil and gas industry, is now expanding into minerals to support a more sustainable energy future. The company’s partnership with Ma’aden combines Aramco’s vast financial resources and technological expertise with Ma’aden’s deep experience in mining and mineral processing. This joint venture is expected to explore and develop lithium reserves within Saudi Arabia, as well as invest in advanced technologies to extract lithium efficiently and sustainably.

Saudi Arabia’s abundant mineral wealth presents a significant opportunity to develop a local lithium supply chain. The JV’s focus will not only be on lithium extraction but also on refining and processing to create high-value products for the battery industry. This strategic initiative aligns with the global push for electrification and green energy solutions, reinforcing the Kingdom’s commitment to reducing carbon emissions and supporting sustainable development.

Why Lithium Matters?

Lithium has become one of the most sought-after minerals in the world due to its essential role in battery technology. The shift towards electric vehicles and renewable energy has significantly increased the demand for lithium, leading to supply shortages and price volatility in global markets. Countries with large lithium reserves have gained strategic importance as they hold the key to the future of clean energy.

Saudi Arabia’s move to invest in lithium mining is timely, as the global lithium supply chain faces challenges such as geopolitical tensions, trade restrictions, and rising extraction costs. By developing its own lithium resources, Saudi Arabia can ensure a stable and secure supply for its domestic industries while also emerging as a competitive player in the global lithium market.

The Impact on Saudi Arabia’s Economy

This joint venture is expected to have several positive economic impacts on Saudi Arabia, including:

- Job Creation: The development of a lithium mining and processing industry will generate thousands of jobs in various sectors, from mining operations to research and development in battery technology. The initiative will also create opportunities for local engineers, scientists, and skilled workers, contributing to the Kingdom’s economic growth.

- Foreign Investment: By establishing a strong domestic lithium industry, Saudi Arabia could attract global battery manufacturers and EV companies to invest in the region. This could lead to the development of battery production facilities, further boosting industrialization and economic diversification.

- Technology Development: The partnership with Ma’aden and other potential international partners will bring cutting-edge lithium extraction and refining technologies to Saudi Arabia. Investing in research and innovation will help the country develop sustainable mining techniques and enhance its competitiveness in the global lithium industry.

- Reduced Dependence on Oil: As part of Vision 2030, Saudi Arabia aims to reduce its economic reliance on oil revenues. Expanding into the lithium market provides a new revenue stream and aligns with the country’s broader goal of economic diversification.

Global Implications

Saudi Arabia’s entry into the lithium market has significant global implications. The global lithium supply chain is currently dominated by a few major producers, including China, Australia, and the United States. With its vast financial resources and government support, Saudi Arabia has the potential to disrupt the existing lithium market dynamics.

By developing its lithium reserves, Saudi Arabia could reduce the world’s dependence on a few key suppliers, thereby improving supply chain resilience and stability. The Kingdom’s involvement in lithium production also strengthens its geopolitical influence, positioning it as a key supplier for emerging energy technologies. Additionally, this move supports the global transition to cleaner energy by ensuring a stable lithium supply for the rapidly growing EV and renewable energy sectors.

Challenges Ahead

Despite the promising outlook, several challenges need to be addressed:

- High Extraction Costs: Lithium mining is resource-intensive, requiring advanced technology and significant investments. Ensuring cost-efficient extraction will be crucial for the success of the joint venture.

- Environmental Concerns: The environmental impact of lithium mining is a growing concern worldwide. Sustainable mining practices and strict regulations will be necessary to minimize damage to ecosystems and water resources.

- Market Competition: Saudi Arabia will need to compete with established lithium-producing nations that already have well-developed supply chains. It will have to invest in infrastructure, research, and international partnerships to gain a competitive edge.

- Technology and Expertise: Developing a domestic lithium industry requires technical know-how and expertise. Collaborating with global technology providers and lithium producers will be essential to overcoming initial challenges.

Final Thoughts

Aramco and Ma’aden’s joint venture represents a bold and strategic move toward Saudi Arabia’s future as a leader in clean energy resources. As global demand for lithium continues to soar, this partnership could significantly impact the Kingdom’s economy and play a crucial role in the worldwide battery supply chain.

With strong government support, abundant mineral resources, and strategic partnerships, Saudi Arabia is well-positioned to become a major player in the global lithium market. The country’s commitment to diversifying its economy and investing in future energy solutions reinforces its vision of becoming a global leader in sustainable and innovative industries.

By investing in lithium, Saudi Arabia is securing its energy future and actively contributing to the global shift towards cleaner, more sustainable energy solutions. This move is a game-changer not only for the Kingdom but for the entire global energy market.

UAE Leaders Extend Warm Congratulations to Saudi King, Crown Prince on Founding Day