Japan’s Orix Corporation and Qatar Investment Authority (QIA) are joining forces to launch a new $2.5 billion private equity fund focused on Japan, marking one of the biggest global partnerships aimed at revitalizing the Japanese market. The move underlines a growing interest from Middle Eastern sovereign wealth funds in Asia’s third-largest economy, particularly in sectors that promise long-term growth and innovation.

The fund, which is expected to begin operations in early 2026, will target investments in key Japanese industries such as renewable energy, advanced manufacturing, technology, healthcare, and infrastructure. It will also explore opportunities in companies undergoing corporate restructuring, buyouts, and transitions toward sustainability and digital transformation.

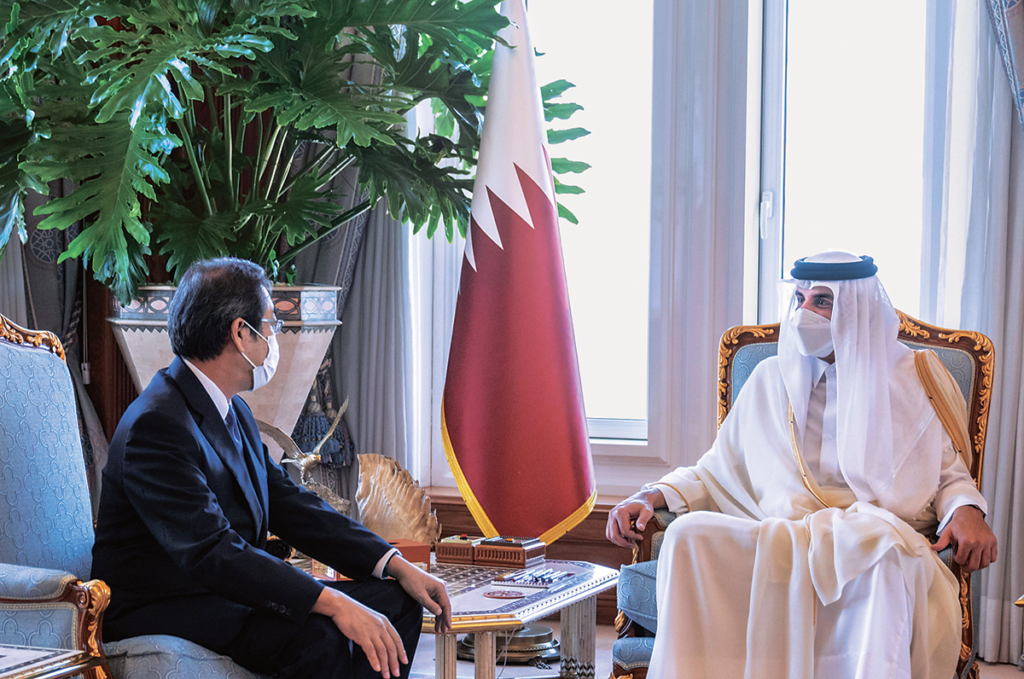

This strategic partnership between Orix, one of Japan’s largest financial services and leasing firms, and QIA, the sovereign wealth fund of Qatar, represents a major step in strengthening economic ties between Japan and the Gulf region.

A new chapter in Japan-Qatar investment relations

According to reports, the new fund will be managed jointly by Orix and QIA teams based in Tokyo and Doha. It will combine Orix’s deep understanding of Japanese markets and corporate structures with QIA’s global investment expertise and financial strength.

The two partners aim to support both mid-sized and large Japanese companies looking for growth capital, expansion opportunities, or global partnerships. The initiative aligns with Japan’s broader national agenda to attract more foreign capital and improve corporate governance in domestic firms.

An Orix spokesperson said the partnership will not only focus on financial returns but also on promoting sustainability and innovation within Japan’s industrial landscape. The company highlighted that the collaboration would “bring together two of the world’s most experienced investment institutions to unlock new value in the Japanese market.”

QIA, which manages over $500 billion in assets globally, has been diversifying its portfolio beyond energy and real estate, increasingly turning to Asia as a strategic growth region. The fund’s Japan focus reflects QIA’s long-term vision to invest in stable, technologically advanced economies with strong fundamentals.

Driving growth in Japan’s private equity market

Japan’s private equity sector has seen steady growth over the past few years, with rising foreign interest in undervalued assets and family-owned companies seeking new ownership models. Analysts note that while Japan has traditionally been cautious toward private equity, attitudes are shifting as companies seek fresh capital for digital upgrades and international expansion.

The entry of Orix and QIA with a $2.5 billion fund could accelerate this transformation. The scale of the fund makes it one of the largest Japan-focused private equity vehicles launched in recent years.

Experts believe that the collaboration could attract additional investors from the Middle East and Asia, boosting confidence in the Japanese market. “This partnership signals a new wave of cross-border investment activity,” said a Tokyo-based investment analyst. “Japan offers stable governance, a mature economy, and strong innovation potential—qualities that appeal to long-term institutional investors.”

Strategic timing amid global economic shifts

The timing of the fund’s launch comes amid a period of major shifts in global capital flows. With interest rates in Western markets remaining high and geopolitical uncertainties weighing on returns, Asia—especially Japan—has become an attractive destination for patient capital.

Japan’s corporate sector is also in transition, with the government pushing for improved shareholder value, transparency, and higher return on equity. These reforms have encouraged international investors to re-evaluate the country’s private equity landscape.

For Qatar, the move is part of its strategy to diversify investments beyond energy revenues. Over the past decade, QIA has expanded its portfolio across Europe, the U.S., and Asia, investing in technology, logistics, and financial services. Partnering with Orix allows QIA to gain a deeper foothold in Japan through a trusted domestic partner.

Focus on sustainable and digital investments

Both Orix and QIA have emphasized that the new fund will prioritize sustainability and digital transformation. This includes investing in renewable energy projects, clean technologies, and companies leading Japan’s transition to a low-carbon economy.

Japan has set ambitious climate targets, aiming for net-zero carbon emissions by 2050. The fund’s investments could play a crucial role in supporting companies aligned with these goals.

Digital innovation is another key focus area. Japan’s manufacturing and service industries are accelerating the adoption of artificial intelligence, robotics, and automation. The fund aims to support companies that integrate advanced technologies into their business models, enhancing productivity and competitiveness.

An executive from Orix mentioned that the fund’s long-term approach would “combine patient capital with strategic partnerships,” allowing portfolio companies to expand sustainably.

Strengthening Japan’s role as an investment hub

The creation of this fund also highlights Japan’s growing appeal as an investment hub for global institutional investors. Recent regulatory changes, including easier rules for foreign acquisitions and improved corporate governance standards, have made the country more open to private equity participation.

Moreover, Japan’s stable political environment and strong infrastructure make it a safe destination for sovereign wealth funds seeking predictable returns.

Analysts suggest that if the Orix-QIA fund performs well, it could pave the way for other Middle Eastern investors to enter the Japanese market, deepening economic and diplomatic ties.

Looking ahead

While specific details about the fund’s structure, management team, and targeted investment size per company are yet to be disclosed, sources close to the development say both sides are finalizing governance frameworks to ensure transparency and efficient decision-making.

Once operational, the fund could play a vital role in financing mergers, acquisitions, and growth strategies for Japanese companies adapting to global competition. It is also expected to generate attractive returns for investors while supporting Japan’s economic modernization efforts.

The partnership between Orix and QIA sends a clear message: Japan remains a key player in the global investment landscape, offering both stability and innovation. For Qatar, it represents a forward-looking investment that aligns with its goal of building diversified, resilient, and sustainable financial assets.

As the global economy faces uncertainty, this collaboration between two of the world’s leading investment institutions could mark the beginning of a new era in Japan’s private equity market.

Do Follow Gulf Magazine on Instagram

Read More:- Non-Saudis Can Own Real Estate in Saudi Arabia – An Exclusive Opportunity from January 2026