AI in Risk Management Empowering Oman’s Financial Institutions for a Safer Future The world of finance in Oman is evolving. Financial institutions across the country face increasing challenges from regulatory demands, cyber threats, credit exposures, and shifting global economic conditions. To thrive, they need smart, agile, forward-looking solutions. Artificial Intelligence (AI) is emerging as that transformational force.

The Need for Smarter Risk Management

Oman’s banks and financial organizations operate in a dynamic environment. Traditional risk assessment methods like manual review, basic statistical models, and historical data snapshots struggle to address real time risks and complex interdependencies. Late detection of credit deterioration, undetected fraud, and poor liquidity planning can cost heavily.

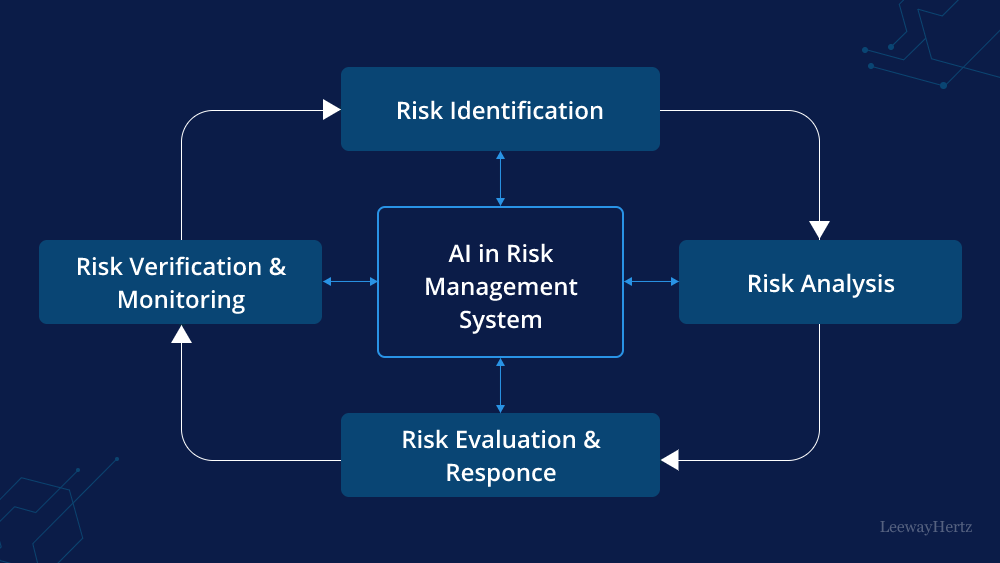

AI changes the narrative. By analysing vast, diverse data sources including transaction patterns, customer behaviour, and macroeconomic indicators, AI uncovers emerging threats long before they materialise. It helps institutions anticipate shifts instead of reacting to them.

How AI Helps Financial Institutions in Oman

AI powered tools offer multiple dimensions of risk mitigation.

Credit Risk Intelligence

Machine learning models assess borrower profiles more deeply, combining credit history, transactional behaviour, economic data, and even social signals. This enables more accurate loan approvals, timely early warning signals, and proactive mitigation strategies.

Fraud Detection and Prevention

AI systems monitor millions of transactions in real time, detecting anomalous patterns that humans or rule based systems might miss. Whether it’s internal fraud or external cyber attacks, AI flags suspicious activity instantly, reducing losses and improving trust.

Operational and Compliance Risk Management

Automated monitoring of policies, regulatory changes, and operational workflows ensures that financial institutions stay compliant. AI can process regulatory texts, map business activities to rules, and trigger alerts when deviations occur, reducing fines and reputation damage.

Market and Liquidity Risk Forecasting

Advanced algorithms simulate market scenarios, analyse liquidity gaps, and model cash flow under stress. AI enables scenario based forecasting that adapts to shifting economic indicators crucial for Oman’s banks balancing local dynamics and global market exposure.

What Oman Needs A Human Centered Approach

Adopting AI in risk management isn’t just about deploying tech it’s about empowering people. Financial institutions must focus on:

Building Trust and Transparency

AI systems should offer explainable outputs, so risk officers and auditors can understand why a decision or alert was triggered. Transparent communication builds confidence internally and among regulators.

Upskilling Teams

Training risk analysts and compliance officers to work alongside AI ensures a smooth human machine partnership. Staff become users and interpreters of AI insights, not replaced by them. This human centered approach fosters acceptance and innovation.

Ethical and Responsible Use

AI must respect privacy and data ethics. Oman’s institutions need clear governance frameworks to ensure data is used responsibly, with respect for customers. Fairness, accountability, and bias mitigation must be designed in from day one.

Real World Benefits for Omani Institutions

AI adoption unlocks powerful advantages.

Enhanced Risk Detection Speed

AI identifies credit deterioration or fraud often in hours instead of weeks. This fast response reduces financial losses and helps institutions act decisively.

Greater Accuracy and Precision

Machine learning models continually improve. Over time, risk predictions become increasingly accurate, reducing false positives, enabling better capital allocation, and improving customer experience.

Cost Savings and Efficiency Gains

Automation reduces manual workload. Compliance checks, transaction monitoring, and risk scoring all become faster and more efficient, allowing teams to focus on strategic analysis and value added tasks.

Competitive Edge

AI driven institutions stay ahead of peers. By proactively managing risks, they unlock smarter lending, targeted products, and agile responses to market changes, attracting trusted customers and investors.

Overcoming Challenges Tailored to Oman

For Omani institutions to fully benefit, they must overcome practical hurdles.

Data Quality and Integration

Data is often fragmented across silos credit bureaus, transaction systems, and external economic data feeds. Building clean, integrated datasets is essential to train effective AI models.

Regulatory Alignment

Financial regulators in Oman may have evolving guidance on AI use. Institutions must engage regulators early, sharing model designs, validation strategies, and compliance plans to build trust.

Infrastructure Investment

AI systems require strong computing infrastructure cloud or local plus secure platforms to handle sensitive financial data. Omani banks need strategic investment plans that balance security, cost, and scalability.

Steps to Implement AI in Risk Management

A clear path helps institutions transition smoothly.

1. Pilot and Proof of Concept

Begin with specific use cases, for example fraud detection for digital payments or credit scoring for SMEs. Pilot models on limited datasets, validate results, and refine.

2. Scale Gradually

Once confidence builds, scale to broader operations retail loans, corporate credit, compliance monitoring. Ensure human teams stay involved to validate outcomes at each stage.

3. Govern and Monitor Continuously

Set up AI audit teams, define performance metrics, monitor model drift, and regularly review fairness and accuracy. Governance ensures AI remains reliable and compliant.

4. Build an AI Driven Culture

Foster a culture where decision makers trust data insights, collaborate with AI systems, and continually seek innovation. Celebrate successes and learn from missteps.

The Human Impact

Behind every algorithm, customers and employees benefit.

- Customers enjoy faster, fairer lending decisions and safer banking experiences.

- Employees feel empowered by tools that help them focus on higher value work, strategic analysis, personalised client advisory, and risk planning.

- Leadership gains deeper insight into emerging threats and opportunities, leading with confidence.

Vision for Oman’s Financial Sector

Imagine a financial ecosystem in Oman that is resilient, responsive, and future forward. AI enabled risk management not only protects institutions but fuels growth, supporting SMEs, enabling digital transformation, and attracting global investment.

Financial institutions that embrace AI responsibly can lead Oman into a new era where risks are managed in real time, decisions are data driven, and people remain at the heart of innovation.

AI in risk management isn’t just a tool, it’s a partner in building a stronger, smarter, and more trusted financial system in Oman.

Do follow Gulf Magazine on Instagram.

Also Read – Oman’s Green Energy Ambition and Storage’s Vital Role