Kuwait’s banking sector is undergoing a remarkable transformation with the integration of blockchain technology. Known for its robust financial institutions and advanced regulatory frameworks, Kuwait has always been at the forefront of innovation in the Gulf region. Now, with blockchain, the country is redefining how transactions are processed, making banking services faster, more secure, and highly efficient. This digital revolution is not just about technology; it is about creating a seamless financial experience for customers and businesses alike.

Understanding Blockchain and Its Relevance to Banking

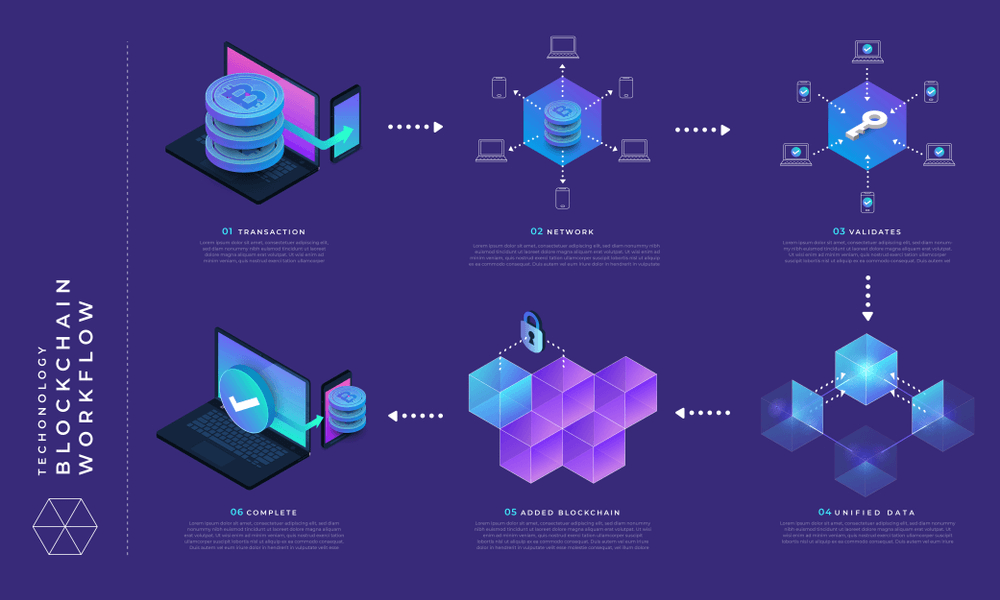

Blockchain is a decentralised digital ledger that records transactions across multiple computers in a way that ensures security, transparency, and immutability. Unlike traditional banking systems that rely on intermediaries for verification, blockchain uses cryptographic techniques to validate and store data. This eliminates the risk of fraud, reduces processing times, and minimises transaction costs.

For the banking sector, this means a fundamental shift in how financial services are delivered. In Kuwait, where cross-border transactions and remittances play a significant role, blockchain offers an ideal solution to enhance efficiency and reliability.

Kuwait’s Drive Towards Digital Transformation

Kuwait has been actively promoting digital transformation across various sectors, including finance. The Central Bank of Kuwait (CBK) has introduced several initiatives to encourage the adoption of advanced technologies like blockchain. This aligns with the country’s Vision 2035, which focuses on innovation, economic diversification, and modernisation of infrastructure.

Banks in Kuwait are leveraging blockchain to streamline their operations and offer faster services to customers. By reducing dependence on outdated systems and manual processes, blockchain enables them to meet the growing demands of a tech-savvy population.

Faster Transactions with Blockchain

One of the most significant advantages of blockchain in Kuwait’s banking sector is the speed of transactions. Traditional cross-border transfers often take several days due to multiple layers of verification. With blockchain, transactions can be completed within minutes, regardless of geographical boundaries.

This is particularly beneficial for Kuwait, where international trade and expatriate remittances are crucial components of the economy. Customers no longer need to wait for long processing times or worry about delays. Instead, they enjoy near-instant settlements with enhanced transparency.

Enhancing Security and Trust

Security is a top priority in financial services, and blockchain addresses this concern effectively. Every transaction recorded on a blockchain is encrypted and linked to the previous one, creating an unalterable chain of data. This makes it virtually impossible to manipulate or hack the system.

For Kuwaiti banks, this means offering clients a higher level of trust and protection. Fraudulent activities are significantly reduced, and compliance with regulatory requirements becomes more streamlined. Customers gain confidence knowing their transactions are safe and transparent.

Cost Efficiency and Reduced Operational Burden

Another major benefit of blockchain adoption in Kuwait’s banking sector is cost efficiency. Traditional systems involve multiple intermediaries, such as clearinghouses and correspondent banks, which increase transaction fees. Blockchain eliminates many of these intermediaries, cutting down operational costs.

Lower costs not only benefit banks but also their customers. Reduced fees for transactions, remittances, and other services make banking more accessible and affordable, contributing to greater financial inclusion in Kuwait.

Use Cases of Blockchain in Kuwaiti Banks

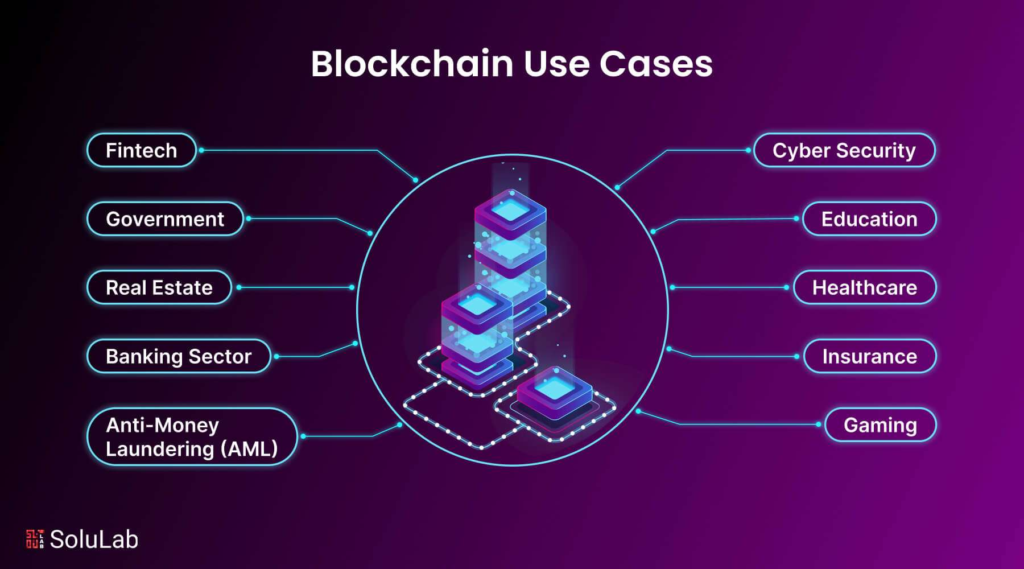

Kuwaiti banks are exploring various applications of blockchain technology to enhance their services. Some notable use cases include:

- Cross-Border Payments – Faster, cheaper, and more transparent international transactions.

- Trade Finance – Streamlining complex trade processes and reducing paperwork.

- Smart Contracts – Automating contract execution without intermediaries, reducing legal and administrative costs.

- KYC and Compliance – Secure and efficient identity verification, minimizing duplication and fraud risks.

These use cases demonstrate how blockchain is reshaping every aspect of banking, from back-office operations to customer interactions.

The Role of FinTech and Collaboration

The rise of blockchain in Kuwait’s banking sector is also fuelled by collaborations between traditional banks and FinTech companies. Startups specialising in blockchain solutions are partnering with banks to create innovative financial products and services.

Such partnerships accelerate the adoption of blockchain while fostering a culture of innovation. They also ensure that banks stay competitive in a rapidly evolving global financial landscape.

Challenges and Considerations

While blockchain offers numerous advantages, its implementation comes with certain challenges. Regulatory uncertainty, integration with existing systems, and the need for skilled professionals are some of the hurdles Kuwaiti banks must overcome.

The Central Bank of Kuwait is actively working to establish clear guidelines and frameworks for blockchain adoption. Continuous investment in talent development and infrastructure is essential to fully harness the potential of this technology.

Future Outlook: A Blockchain-Powered Banking Landscape

The future of banking in Kuwait looks promising with blockchain at its core. As more banks adopt this technology, customers will experience unprecedented levels of efficiency, security, and convenience.

Blockchain is expected to play a critical role in shaping Kuwait’s financial ecosystem over the coming years. From faster payments to advanced financial products, the technology will continue to redefine how banking services are delivered.

Conclusion

Blockchain is revolutionising Kuwait’s banking sector by enabling faster transactions, enhanced security, and cost-effective operations. This powerful technology aligns perfectly with Kuwait’s vision of becoming a regional hub for innovation and digital excellence. As banks continue to embrace blockchain, they are not only improving their services but also paving the way for a future where financial transactions are seamless, transparent, and instant.

The adoption of blockchain is no longer a choice but a necessity for banks seeking to thrive in the modern financial landscape. For Kuwait, this transformation is a significant step toward a smarter and more efficient economy.

Do follow Gulf Magazine on Instagram.

Also Read – UAE Dirham & Indian Rupee: 8 Powerful Steps to Boost Settlement