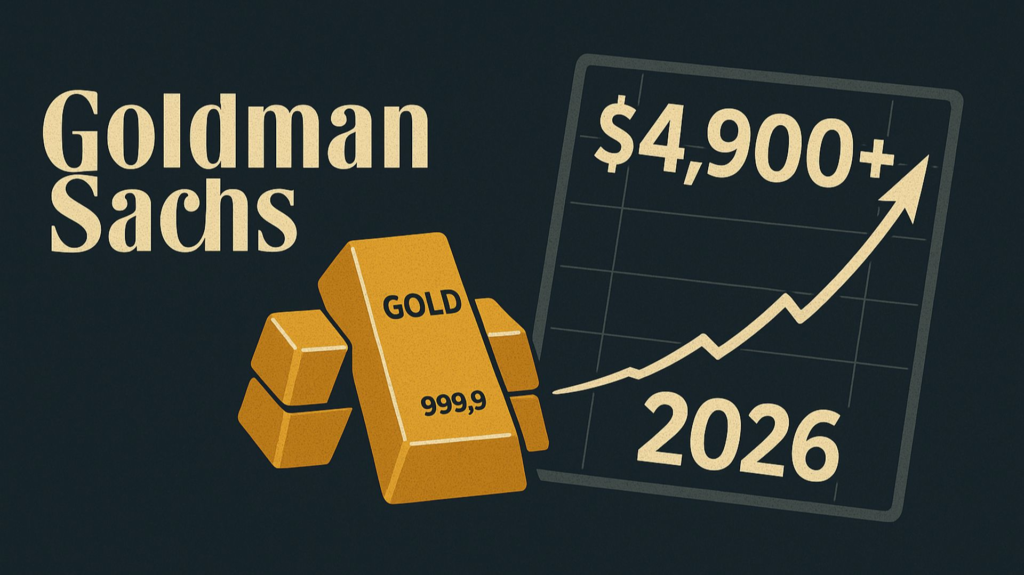

Gold is once again stepping into the spotlight as one of the most compelling investment stories of the coming years. According to Goldman Sachs, the precious metal is expected to emerge as a top-performing commodity in 2026, supported by strong central bank demand, persistent geopolitical tensions, and shifting global monetary dynamics. In a bold outlook, the investment bank suggests that gold prices could climb toward an astonishing $4,900 per ounce by the end of 2026, a level that would mark a historic milestone for the metal.

This forecast has reignited global interest in gold, not just among institutional investors but also among individuals seeking stability in an increasingly uncertain world. The renewed optimism around gold reflects deeper changes in the global economy and the way nations and investors perceive risk.

Why Goldman Sachs Is Confident About Gold’s Future

Goldman Sachs’ bullish stance is rooted in a combination of structural and cyclical factors that are reshaping demand for gold. Unlike short-term price movements driven by speculation, the bank’s outlook is anchored in long-term trends that are unlikely to fade anytime soon.

At the heart of this confidence lies the growing role of gold as a strategic asset rather than a purely defensive one. As global financial systems face mounting stress, gold is being repositioned as a core component of reserves, portfolios, and long-term wealth preservation strategies.

Central Bank Buying Is Redefining Gold Demand

One of the most powerful drivers behind the gold rally forecast is aggressive central bank buying. Over the past few years, central banks around the world have been steadily increasing their gold reserves, viewing the metal as a hedge against currency volatility and geopolitical pressure.

This trend is particularly strong among emerging economies seeking to reduce reliance on the US dollar. By diversifying reserves into gold, these nations aim to protect their financial sovereignty and shield themselves from external economic shocks. Goldman Sachs believes this sustained demand from central banks will continue well into 2026, providing a strong and consistent floor for gold prices.

Unlike retail demand, central bank purchases are large-scale, strategic, and long-term in nature, making them a powerful stabilising force in the gold market.

Geopolitical Risks Are Fueling Safe-Haven Demand

Geopolitical uncertainty remains a defining feature of the global landscape, and gold has historically thrived during such periods. From regional conflicts and trade tensions to political instability and shifting alliances, investors are facing an environment where traditional risk assessments are constantly being challenged.

Goldman Sachs points out that these ongoing risks are reinforcing gold’s role as a safe-haven asset. When confidence in financial markets wavers, gold often becomes the asset of choice for preserving value. As geopolitical pressures show little sign of easing, gold’s appeal is expected to strengthen further in the years ahead.

This dynamic makes gold uniquely positioned to benefit from both sudden crises and prolonged periods of global tension.

Inflation, Interest Rates, and the Changing Monetary Landscape

Another critical factor supporting gold’s outlook is the evolving monetary environment. While inflation may fluctuate, concerns about long-term purchasing power persist across economies. Gold has long been viewed as a hedge against inflation, offering protection when currencies lose value over time.

Goldman Sachs also highlights the impact of interest rate cycles. As global economies move closer to potential rate cuts or more accommodative policies, the opportunity cost of holding non-yielding assets like gold decreases. This creates a more favourable environment for gold prices to rise, particularly when combined with strong underlying demand.

The convergence of inflation concerns and shifting rate expectations could act as a powerful catalyst for gold in 2026.

The Road to $4,900: How Realistic Is the Target?

A price target of $4,900 per ounce may sound ambitious, but Goldman Sachs argues that it is achievable under the right conditions. The bank’s forecast assumes a continuation of strong central bank demand, heightened geopolitical risks, and a supportive macroeconomic backdrop.

If investment demand accelerates alongside institutional buying, gold could experience a supply-demand imbalance that pushes prices sharply higher. Gold supply growth remains relatively constrained, as mining output struggles to keep pace with rising demand.

In such a scenario, even modest increases in investment flows could have an outsized impact on prices, bringing the $4,900 level within reach.

How Investors Are Responding to the Gold Outlook

The renewed optimism around gold is already influencing investor behaviour. Institutional investors are revisiting their exposure to precious metals, while retail investors are showing increased interest in gold-backed assets.

For many, gold is no longer just a hedge but a strategic allocation designed to balance portfolios and reduce overall risk. Goldman Sachs’ forecast has added credibility to this approach, encouraging investors to view gold as a long-term opportunity rather than a short-term trade.

This shift in perception could further amplify demand, reinforcing the upward momentum projected for 2026.

Gold’s Role in a Diversified Portfolio

Gold’s appeal extends beyond price appreciation. It plays a crucial role in diversification, often moving independently of equities and bonds. During periods of market stress, gold has historically helped offset losses in other asset classes.

Goldman Sachs emphasises that gold’s value lies not only in its potential upside but also in its ability to stabilise portfolios during turbulent times. As market correlations increase and traditional diversification strategies become less effective, gold offers a rare source of balance and resilience.

This makes gold particularly attractive in an era marked by economic uncertainty and rapid change.

What 2026 Could Mean for the Global Gold Market

If Goldman Sachs’ forecast proves accurate, 2026 could mark a defining chapter in gold’s modern history. A surge toward $4,900 per ounce would reshape perceptions of the metal and reinforce its status as a cornerstone of the global financial system.

Such a rally would also have broader implications, influencing mining investment, currency markets, and global trade dynamics. Gold-producing nations could benefit from higher revenues, while investors worldwide reassess the role of precious metals in their financial planning.

The impact would extend far beyond the gold market itself, reflecting deeper shifts in how value and security are defined in the global economy.

A Golden Opportunity on the Horizon

Goldman Sachs’ bullish outlook for gold in 2026 underscores a powerful narrative: in a world defined by uncertainty, gold remains a symbol of stability, trust, and enduring value. With central banks leading the charge, geopolitical risks intensifying, and monetary conditions evolving, gold appears well-positioned for a remarkable run.

While no forecast is guaranteed, the convergence of these forces makes gold’s case compelling. For investors seeking both protection and opportunity, the coming years may indeed represent a golden era one where gold shines brighter than ever before.

Do follow Gulf Magazine on Instagram.

Also Read – UAE Equities Slip Slightly But End Year On Strong Note