The Gulf’s restaurant delivery market is set for a major transformation in 2025. Industry experts and business analysts predict a 60% growth by the end of the year. With rising demand for online food services, expanding digital infrastructure, and the growing preference for convenience, this trend shows no signs of slowing down.

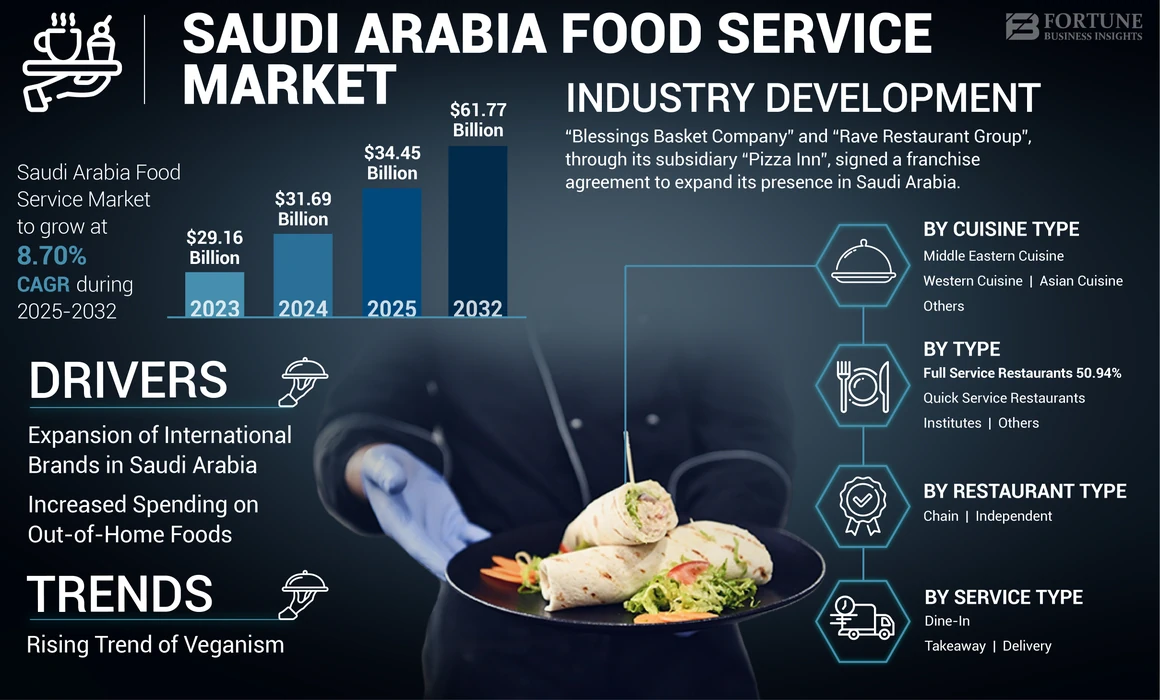

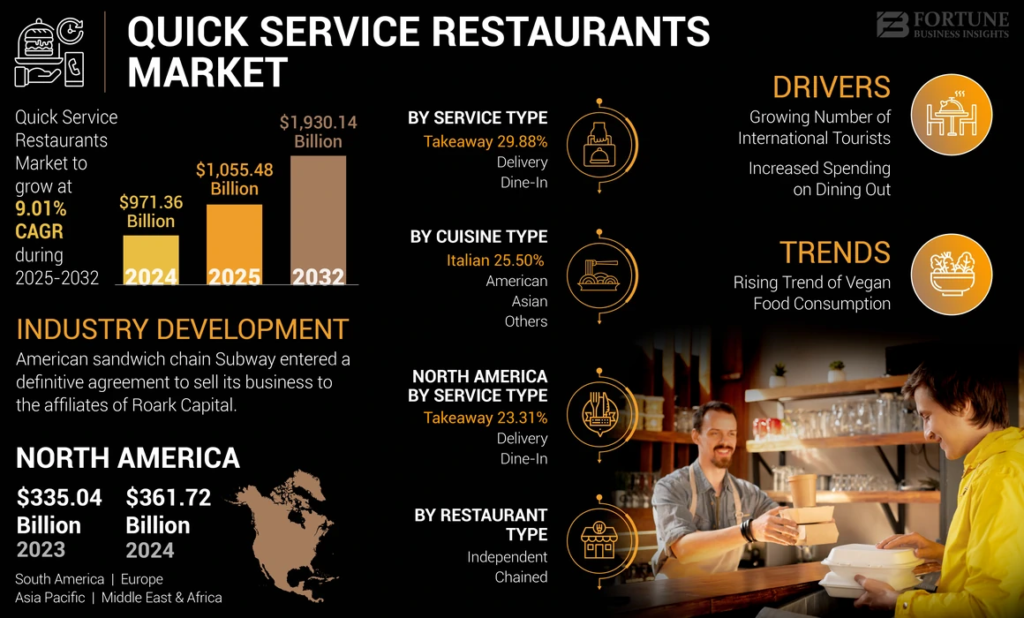

This sharp increase highlights a major shift in consumer behavior, business models, and food service dynamics in Gulf countries like the UAE, Saudi Arabia, Qatar, and Kuwait.

Surge in Online Food Orders

The COVID-19 pandemic laid the foundation for a booming food delivery industry. Even after restrictions eased, the comfort of online food delivery became a habit for many. Platforms such as Talabat, Deliveroo, Careem Now, and Zomato continue to see record orders in the Gulf.

In 2024 alone, the Gulf’s restaurant delivery market was valued at nearly $7 billion. By the end of 2025, this number could reach over $11 billion if the predicted 60% growth occurs. Food delivery apps now offer everything from five-star restaurant meals to budget-friendly local dishes.

Why Is the Market Growing So Fast?

Several reasons contribute to the explosive growth of the Gulf’s restaurant delivery market:

1. Rapid Urbanization

Gulf cities are expanding quickly. As more people move to urban areas for jobs and lifestyle, demand for food delivery increases. Busy professionals prefer ordering in rather than cooking or dining out, especially during weekdays.

2. Young, Tech-Savvy Population

A large portion of the Gulf population is under 35 and tech-friendly. This demographic prefers using smartphones for everything—especially food ordering. With fast mobile internet and modern payment methods, delivery apps have become second nature.

3. Expanding Restaurant Partnerships

Restaurants are increasingly partnering with delivery platforms to widen their reach. Small and medium-sized food businesses are now able to scale up by joining platforms like Talabat and Deliveroo. Cloud kitchens (restaurants without dine-in spaces) have also become a big part of the Gulf’s restaurant delivery market.

4. Digital Advancements

Smart features like real-time tracking, AI-based recommendations, and fast digital payments are attracting more users. The rise of hyperlocal delivery networks is making food delivery faster than ever.

Big Investment Is Fueling the Boom

Major investors are pouring money into food delivery startups and services in the Gulf. Companies are raising millions to improve operations, customer service, and logistics. In Dubai and Riyadh, there are plans to launch fully automated kitchens and drone deliveries by 2026.

Governments are also supporting this trend. Many Gulf countries are focused on diversifying their economies beyond oil, and digital food services are a key part of their plans.

Changing Consumer Habits

Consumers in the Gulf are looking for variety, speed, and convenience. According to a recent survey, 72% of residents in the UAE ordered food online at least twice a week in 2024. This number is expected to rise further in 2025.

Moreover, people now expect 30-minute or less delivery time. This demand has led to the rise of “dark kitchens” or ghost kitchens that are optimized for speed and delivery rather than dine-in.

Impact on Traditional Restaurants

The rise of delivery apps is both a challenge and opportunity for traditional restaurants. Some smaller outlets struggle to keep up with commission fees charged by delivery apps. However, those who adapt to the digital wave are thriving.

Restaurants that invest in packaging, app visibility, and social media are performing well. Menu items are being redesigned for better delivery experience, ensuring that quality is not compromised during transit.

Sustainability and Health Trends

Another major factor shaping the Gulf’s restaurant delivery market is the shift towards healthy and sustainable eating. More people are ordering vegan, gluten-free, and low-calorie meals. Eco-friendly packaging is also becoming a key focus for delivery companies and restaurants.

As people become more health-conscious, apps are promoting calorie counts, nutrition info, and healthy combos to stay ahead of the curve.

Job Creation and Gig Economy

The growing market has created thousands of jobs in the gig economy. Delivery riders, customer service agents, and kitchen workers are now in high demand. In countries like Saudi Arabia and the UAE, local employment in the food tech sector has seen double-digit growth.

With more orders comes the need for a stronger backend—from logistics to customer handling to tech development. This ripple effect is creating new income opportunities across the region.

The Road Ahead

If the Gulf’s restaurant delivery market continues on this path, it may become one of the largest segments in the region’s digital economy. More innovations are expected in 2025, including:

- Drone deliveries in limited zones

- AI-based menu planning

- Smart food lockers for pick-up

- Personalized subscription plans

At the same time, competition will grow fiercer. Companies will need to focus on speed, quality, and customer loyalty to stay ahead.

Final Thoughts

The expected 60% growth in the Gulf’s restaurant delivery market is a sign of broader changes in how people eat, work, and live. This is not just a food trend—it’s part of a deeper shift toward a digital-first lifestyle across the Gulf.

Restaurants, investors, and governments all stand to benefit if they understand the direction and demands of this fast-changing market. For consumers, it means more options, better services, and greater convenience than ever before.

Also Read – Urgent Reforms in Gulf Restaurant Waste Management Systems (2025)