Kuwait GDP growth saw a modest yet meaningful rise of 1% in the first quarter of 2025, marking a positive turnaround after seven consecutive quarters of economic contraction. The latest data released by Kuwait’s Central Statistical Bureau suggests that the country’s economy may be slowly recovering, fuelled by both an increase in oil output and resilience in the non-oil sectors.

This positive trend in Kuwait GDP growth offers a ray of hope to investors, policymakers, and citizens after nearly two years of steady economic decline due to global oil volatility and regional uncertainties.

What the 1% GDP Growth Means for Kuwait

A 1% GDP growth may seem modest on the surface, but considering Kuwait’s recent economic history, it is a significant development. For seven consecutive quarters, the country experienced contraction, primarily driven by fluctuating oil prices, OPEC+ production cuts, and lower foreign investment.

The Q1 2025 numbers indicate a potential economic rebound, especially as the oil sector gradually stabilises and non-oil industries start to show signs of growth. This signals that Kuwait is taking strategic steps to diversify its economy, which has long been heavily dependent on oil revenues.

Oil Sector Plays a Vital Role in GDP Boost

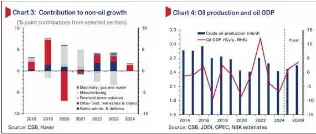

The Kuwait GDP growth in Q1 was mainly supported by a rebound in oil production, which contributes nearly 90% of government revenue. After facing restrictions under OPEC+ agreements, Kuwait slightly increased its production in early 2025 as the global market began to balance supply and demand.

Oil exports rose by approximately 3% compared to Q4 2024, contributing significantly to the national income. Moreover, the average price per barrel remained above $80, further improving revenue collections.

Experts from the Ministry of Finance noted that higher oil revenue was crucial in pushing the GDP into positive territory. However, they also cautioned that relying solely on oil could still pose risks in the long term.

Non-Oil Sector Also Shows Stability

While the oil industry remains Kuwait’s economic backbone, the non-oil sector also played a key role in this quarter’s Kuwait GDP growth. Key contributors included:

- Banking and financial services

- Construction and infrastructure projects

- Telecommunications

- Retail and domestic trade

The government’s Vision 2035 reform initiative, aimed at transforming Kuwait into a financial and trade hub, continues to create investment opportunities and promote private sector involvement.

Local entrepreneurs and small businesses have also shown growth, especially in retail, tech, and logistics, contributing to the non-oil GDP performance.

Expert Opinions on the Q1 GDP Growth

Several economic experts and analysts have weighed in on the Q1 data. According to Dr. Fatima Al-Sabah, an economist at Kuwait University:

“A 1% GDP growth after seven negative quarters is a clear signal that Kuwait is on a slow but steady path to recovery. It’s crucial to maintain fiscal discipline and encourage private-sector-led initiatives.”

Similarly, Mohammed Al-Harbi, financial advisor at Kuwait Finance House, mentioned:

“The oil rebound helped, but the real game-changer will be sustainable investment in technology, education, and infrastructure. This is what will determine future Kuwait GDP growth.”

Employment Impact of the GDP Increase

The positive Kuwait GDP growth in Q1 has not yet translated into significant employment gains, but there are early indicators of labor market stability. Job creation in construction and retail has shown mild improvement, while banking and telecoms continue to recruit actively.

Youth unemployment remains a concern, but several government-backed training programs are being launched in partnership with private companies to boost job readiness and reduce dependency on public sector roles.

Government Policies Supporting the Growth

To support and sustain Kuwait GDP growth, the government introduced several fiscal and monetary measures:

- Subsidies for small and medium enterprises (SMEs)

- Investment incentives for local and foreign investors

- Public-private partnerships in infrastructure

- Digital transformation of public services

Additionally, Kuwait’s sovereign wealth fund has been actively investing in diversified assets globally to ensure long-term financial stability.

These efforts are helping cushion the economy from future oil price shocks and are designed to create a broader, more sustainable growth foundation.

Regional and Global Comparisons

Compared to other Gulf nations, Kuwait’s recovery has been slower, but the recent Kuwait GDP growth suggests it is finally catching up.

For example:

- Saudi Arabia reported a 1.8% GDP growth in Q1

- UAE registered 2.1% growth, driven by tourism and trade

- Qatar grew by 1.5%, supported by LNG exports

However, unlike its neighbours, Kuwait’s parliament-driven political structure can slow down policy reforms, which is often cited as a bottleneck for faster economic revival.

Risks That Could Threaten Future Growth

Despite the positive Q1 report, multiple economic risks could hinder future Kuwait GDP growth, such as:

- Global oil price instability

- Delays in structural reforms

- Geopolitical tensions in the region

- Slow privatization of state-owned enterprises

The Central Bank of Kuwait has warned that continued budget deficits and over-dependence on public sector employment could negatively impact growth if not addressed swiftly.

The Road Ahead: Forecast for the Next Quarters

Most analysts believe that Kuwait GDP growth will likely remain between 1% to 2.5% for the rest of 2025, assuming global oil prices remain stable and reforms continue.

If the government accelerates its Vision 2035 goals, reduces bureaucracy, and attracts more foreign direct investment (FDI), Kuwait’s economy could see stronger growth in 2026.

There is also growing optimism around renewable energy projects, smart city development, and education reform all of which are long-term drivers of inclusive and sustainable economic growth.

Conclusion

The 1% Kuwait GDP growth in Q1 2025 is a welcome sign for a country that has been grappling with economic contraction for almost two years. The turnaround, while modest, reflects improving oil revenues and early progress in diversifying the economy.

To build on this momentum, Kuwait must remain committed to reform, invest in its people, and reduce reliance on oil. With the right strategies, the country can move toward a more resilient and dynamic economy.

Do follow Gulf Magazine on Instagram

Also Read – Kuwait Grace Period Starts: 4 Months to Fix Residency