For decades, investors turned to metals—especially gold—as a dependable store of value. Industrial metals like copper and aluminum followed global growth cycles but still offered predictability. Today, however, rapid price swings across nearly all major metals are challenging that assumption. Economic uncertainty, geopolitical tensions, supply disruptions, and financial speculation have combined to create a new era where even traditional safe assets behave unpredictably.

This shift is forcing governments, businesses, and individual investors to rethink risk, diversification, and long-term planning.

Metals Price Volatility Signals a New Market Reality

Metals markets have always moved with economic cycles, but recent fluctuations are unusually sharp and frequent. Prices surge on supply fears, collapse on demand worries, then rebound within weeks. Such instability reflects deeper structural changes in the global economy.

Several forces are driving this volatility:

- Persistent inflation concerns

- Interest rate uncertainty

- Energy price swings

- Supply chain disruptions

- Geopolitical conflicts

- Rapid shifts in industrial demand

Organizations like the International Monetary Fund have warned that commodity markets are becoming more sensitive to shocks. A single event—such as a mine shutdown, trade restriction, or currency movement—can now ripple through global prices almost instantly.

Unlike past decades, where price movements unfolded gradually, modern markets react in real time due to algorithmic trading and global connectivity.

Gold No Longer Moves Predictably as a Safe Haven

Gold has long been considered the ultimate financial refuge. During crises, investors traditionally flocked to it, pushing prices steadily upward. But recent years have shown that gold can fall sharply even when global risks rise.

This paradox stems from competing forces:

- Rising interest rates make bonds more attractive

- Stronger currencies reduce gold demand

- Investor capital shifts to digital or alternative assets

- Central bank policies create uncertainty

Data from the World Gold Council indicates that gold demand patterns are becoming more complex. Central banks may buy aggressively while retail investors sell, or vice versa, producing unstable price trends.

As a result, gold’s role as a predictable hedge is weakening. It still holds long-term value, but short-term safety is no longer guaranteed.

Industrial Metals Reflect Global Economic Anxiety

While precious metals struggle with identity, industrial metals are reacting even more dramatically to economic signals.

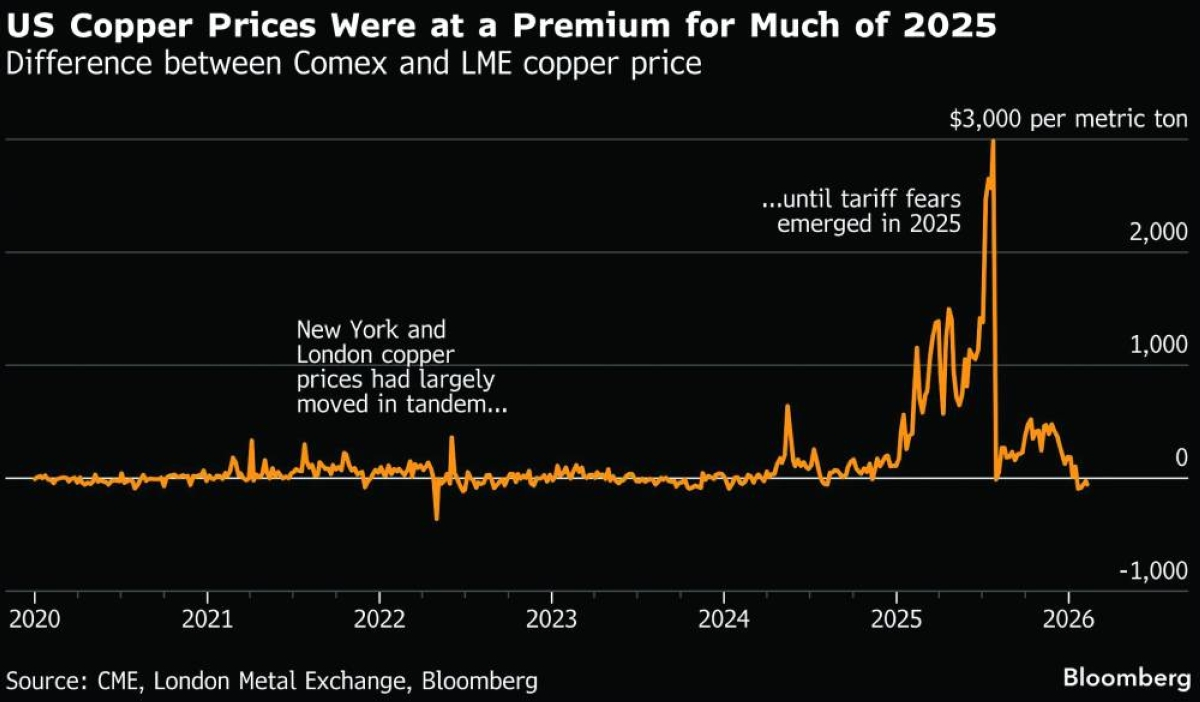

Copper, often called “Dr. Copper” for its ability to predict economic health, has experienced dramatic ups and downs. Aluminum, nickel, and zinc show similar patterns. Prices surge on expectations of infrastructure spending or green energy growth, then drop sharply when recession fears emerge.

The London Metal Exchange, one of the world’s main trading hubs for industrial metals, has seen unprecedented volatility spikes in recent trading sessions. These swings highlight how tightly metal demand is linked to manufacturing, construction, and technology sectors.

Key drivers include:

- Slowing global growth

- Real estate downturns in major economies

- Electric vehicle production shifts

- Trade tensions affecting supply routes

In short, industrial metals now mirror uncertainty rather than stability.

Supply Shocks Are Becoming More Frequent

Another major contributor to metals price volatility is the fragility of global supply chains.

Mining operations face numerous risks:

- Political instability in resource-rich regions

- Environmental regulations and licensing delays

- Labor disputes

- Natural disasters

- Energy shortages

Even a temporary disruption can cause immediate price spikes because inventories are often limited. Years of underinvestment in mining have also reduced spare capacity, leaving little buffer when demand rises suddenly.

For example, restrictions on exports from major producers can send shockwaves through global markets within days. These supply shocks make prices jump unpredictably, undermining the idea of metals as stable assets.

Energy Costs Add Another Layer of Uncertainty

Metal production is extremely energy-intensive. Smelting aluminum, refining copper, and processing steel require vast amounts of electricity and fuel. When energy prices surge, production costs rise, pushing metal prices higher.

However, if high costs force factories to cut output, prices may later collapse due to weaker demand. This push-and-pull dynamic creates volatility cycles that are difficult to forecast.

Energy transitions toward renewable sources also introduce uncertainty. While green policies aim to stabilize long-term supply, the transition period involves fluctuating costs and infrastructure changes that disrupt markets.

Financial Speculation Amplifies Price Swings

Modern commodity markets are heavily influenced by financial investors, not just physical buyers and sellers. Hedge funds, institutional traders, and algorithmic systems can move billions of dollars within seconds.

This financialization has several consequences:

- Prices respond to interest rates and currency moves

- Short-term trading increases volatility

- Market sentiment can outweigh real supply-demand fundamentals

- Sudden capital inflows or outflows cause sharp price changes

When investors treat metals as financial instruments rather than physical commodities, prices can disconnect from real-world needs. A factory may still require copper, but speculative selling could push prices down anyway.

Currency Fluctuations Complicate the Picture

Most metals are priced in U.S. dollars. Therefore, currency movements significantly affect prices worldwide.

When the dollar strengthens:

- Metals become more expensive for non-dollar buyers

- Demand may weaken

- Prices can fall

When the dollar weakens:

- Metals become cheaper internationally

- Demand may rise

- Prices often increase

Because currency markets themselves are volatile, they add another unpredictable layer to metal pricing.

Green Energy Transition Creates Conflicting Pressures

The global push toward clean energy is increasing demand for certain metals, particularly those used in batteries, electric vehicles, and renewable infrastructure.

High-demand metals include:

- Copper

- Lithium

- Nickel

- Cobalt

- Aluminum

In theory, rising demand should support stable long-term prices. In practice, however, expectations fluctuate rapidly based on policy changes, technological breakthroughs, or economic slowdowns.

For example, a government subsidy for electric vehicles can drive prices up quickly, while a policy reversal can cause an equally sharp decline.

This uncertainty makes it difficult to treat green-transition metals as reliable investments.

Emerging Markets Feel the Impact Most

Countries that rely heavily on metal exports or imports are especially vulnerable to price swings.

Exporting nations may experience:

- Revenue instability

- Budget uncertainty

- Currency volatility

- Economic slowdown during price drops

Importing nations face:

- Rising manufacturing costs

- Inflationary pressure

- Trade imbalances

For developing economies, metals price volatility can translate directly into social and economic challenges.

Investors Struggle to Find True Safe Havens

The core issue highlighted by metals price volatility is the apparent disappearance of dependable safe assets.

Traditional safe havens included:

- Gold

- Government bonds

- Stable currencies

- Diversified commodities

Today, each of these faces its own risks. Bonds are sensitive to interest rate changes. Currencies fluctuate due to geopolitical shifts. Even gold behaves inconsistently.

As a result, investors increasingly rely on diversification rather than any single asset for protection.

Central Banks Are Adapting Their Strategies

Central banks around the world continue to hold gold reserves, but they are also diversifying into other assets. Some are increasing holdings of foreign currencies, while others invest in strategic commodities.

Their goal is to reduce dependence on any one asset class. This reflects a broader recognition that stability now requires flexibility.

Businesses Face Planning Challenges

Manufacturers that depend on metals must manage unpredictable input costs. Sudden price increases can squeeze profit margins, while sudden drops can affect inventory values.

To cope, companies are adopting strategies such as:

- Long-term supply contracts

- Hedging through futures markets

- Diversifying suppliers

- Investing in recycling and efficiency

Even with these measures, planning remains difficult in highly volatile markets.

Consumers Ultimately Bear the Cost

When metal prices rise, the effects ripple through the economy:

- Higher construction costs

- More expensive vehicles

- Increased prices for electronics

- Infrastructure delays

Conversely, price crashes can lead to layoffs in mining regions and reduced investment in new projects, affecting employment and growth.

Thus, volatility affects everyday life even for those who never trade commodities.

Is Stability Possible in the Future?

Some analysts believe volatility will remain elevated for years due to structural changes in the global economy. Others argue that increased mining investment and technological improvements could stabilize supply.

Potential stabilizing factors include:

- Expanded recycling capabilities

- New mining projects

- More efficient production methods

- Improved global cooperation on trade

However, these solutions take time to implement, meaning short-term uncertainty is likely to persist.

What Investors Can Learn from Metals Price Volatility

The key lesson is that no asset is completely immune to global shocks. Instead of searching for a single safe haven, experts recommend building resilient portfolios that can withstand multiple scenarios.

Practical strategies include:

- Diversification across asset classes

- Long-term investment horizons

- Risk management tools

- Regular portfolio rebalancing

Understanding the forces behind price movements can also help investors avoid panic decisions during sudden swings.

Conclusion: A World Without Clear Shelter

Metals price volatility reveals a deeper truth about the modern financial system: stability is no longer guaranteed anywhere. Globalization, technological change, climate policy, and geopolitical tensions have interconnected markets so tightly that shocks spread instantly across sectors.

Metals remain essential to the world economy, but they no longer offer simple protection against uncertainty. Instead, they reflect that uncertainty.

In this new environment, resilience—not refuge—has become the ultimate goal. Investors, governments, and businesses must adapt to a world where safety comes from flexibility, diversification, and preparedness rather than reliance on any single asset.

As markets continue to evolve, the search for reliable safe havens may give way to a more realistic approach: managing risk rather than escaping it.

Do Follow Gulf Magazine on Instagram

Read More:- Saudi Arabia’s Bold Shift Aims to Attract Global Investors Fast 2025