Qatar Introduces First Real-Time Payee Verification Service to Enhance Financial Security

Doha, Qatar Alfardan Exchange, one of Qatar’s leading financial services providers, has partnered with global fintech company iPiD (International Payment Identity) to launch the country’s first-ever real-time payee verification service. This cutting-edge solution is set to transform digital payments by increasing transparency, reducing fraud, and strengthening customer confidence.

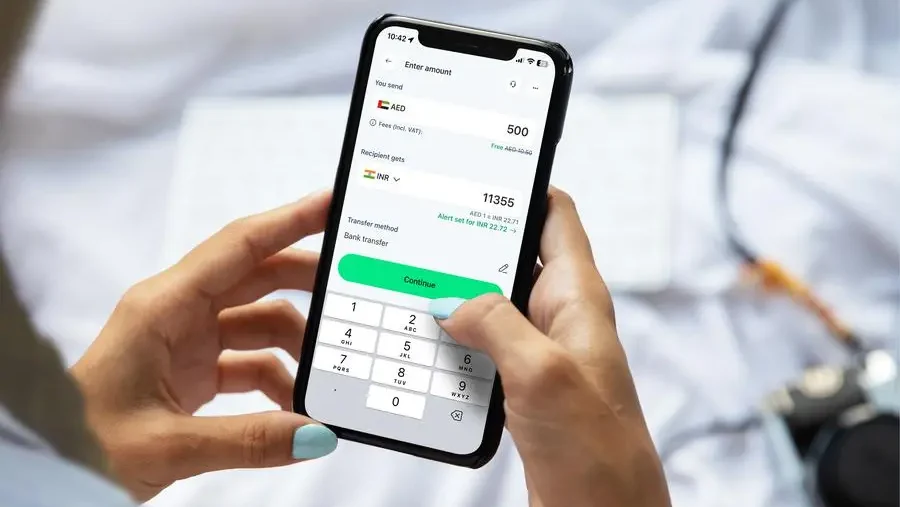

In a major step toward safer and smarter digital banking, this new service will allow users to confirm the identity of their recipients before sending money—ensuring transactions go to the right person or business.

Enhancing Trust in Digital Payments

The new real-time payee verification service enables customers to see the name of the recipient before a transaction is completed. This feature is designed to prevent common mistakes, such as sending money to the wrong account due to incorrect account details or falling victim to scams.

Until now, most digital transactions in Qatar relied on users entering account numbers or international bank details (like IBANs) without any confirmation that those details matched the intended recipient. This opened the door for errors and fraud—especially in cross-border payments.

“Our collaboration with iPiD reflects our commitment to providing secure and efficient financial services,” said Bashar Al Waqfi, CEO of Alfardan Exchange. “This real-time verification tool is a significant step forward in protecting our customers and enhancing their trust in digital transactions. We believe this service will raise the bar for payment accuracy and user confidence in Qatar’s financial ecosystem.”

By adopting this verification system, Alfardan Exchange positions itself as a pioneer in offering advanced digital solutions that place customer protection at the forefront.

Aligning with Global Financial Standards

Countries such as the United Kingdom and members of the European Union have already introduced similar verification processes—like the UK’s Confirmation of Payee system and the EU’s Verification of Payee regulations. These initiatives have proven effective in reducing fraud and improving transaction success rates.

Now, Qatar is stepping onto the global stage with its own version of this best practice.

“Partnering with Alfardan Exchange enables us to bring our advanced verification solutions to the Qatari market,” said Alain Raes, co-founder and Chief Commercial Officer of iPiD. “Our goal is to support financial institutions in delivering secure and compliant payment services that give users peace of mind—especially in a time when digital adoption is accelerating.”

iPiD, which provides payee verification services across Asia, Europe, and the Middle East, uses smart technology and bank integrations to confirm payee names in real time. This helps banks and money transfer operators (MTOs) prevent misdirected payments and avoid costly reversals or disputes.

A Big Leap for Qatar’s Digital Transformation Goals

This milestone fits squarely into Qatar’s ongoing digital transformation strategy, as outlined in the country’s National Vision 2030. Financial digitization is a key pillar in building a knowledge-based economy—and secure digital infrastructure is essential for long-term success.

The introduction of this real-time verification service not only reduces financial crime but also encourages more people to trust and adopt digital payments, especially for personal remittances and business transfers.

“Digital safety and convenience go hand in hand,” added Al Waqfi. “This new feature is just the beginning. We’re looking at a future where digital money transfers are as secure as they are seamless.”

Alfardan Exchange is already known for its proactive approach to tech-driven innovation. The company recently rolled out a digital customer journey across its branches, allowing users to complete transactions using digital signatures and receive instant digital receipts. This move significantly reduced paper usage and operational friction—aligning with global sustainability practices.

Why This Matters for Individuals and Businesses

Digital fraud has been on the rise globally, with scammers becoming more sophisticated in impersonating legitimate payees. From phishing emails to fake invoices, users across both retail and corporate banking are at risk.

Real-time verification acts as a frontline defense against such risks.

For individuals sending remittances, this means added peace of mind that funds are reaching their loved ones and not being intercepted. For businesses, especially SMEs operating internationally, this tool provides a layer of protection that could save thousands of riyals in potential losses.

Moreover, payment errors often result in operational delays, customer dissatisfaction, and regulatory issues. Preventing these issues before they occur makes the payment process more efficient and trustworthy.

What’s Next for Alfardan Exchange and Qatar’s Fintech Landscape

Looking ahead, Alfardan Exchange plans to deepen its cooperation with iPiD and other tech partners to roll out more customer-centric innovations. The goal is to create a seamless, secure, and transparent financial experience across all touchpoints—whether in-branch or online.

With the fintech sector in Qatar gaining momentum, this move also sets a benchmark for other players in the industry. As more financial institutions join the trend, it’s likely that real-time payee verification will become the new standard in Qatar, much like it has in Europe and Asia.

This partnership is not just about technology—it’s about trust, user empowerment, and long-term financial resilience. In a region rapidly adopting digital banking, initiatives like this help pave the way for a more secure and inclusive future.

Conclusion

The launch of Qatar’s first real-time payee verification service marks a significant moment in the country’s digital evolution. By embracing secure and transparent financial technology, Alfardan Exchange and iPiD are not only protecting customers but also strengthening Qatar’s global fintech reputation.

As digital payment volumes grow, innovations like this are essential in building a trusted ecosystem that supports individuals, businesses, and the national economy.

For more information click here

Qatar’s Ashghal Set to Award Major Healthcare Design Contract Soon