Qatar’s air conditioner market is poised for significant growth, driven by its extreme climate, rapid urbanization, and increasing infrastructure development. According to recent industry research, the market is expected to reach $626.60 million by 2033, expanding at a compound annual growth rate (CAGR) of 6.65% from 2025 to 2033. The rising demand for energy-efficient and technologically advanced air conditioning solutions has further fueled this growth trajectory.

Market Drivers

Qatar’s climate, characterized by sweltering temperatures often exceeding 45 degrees Celsius, makes air conditioning an essential requirement for both residential and commercial spaces. With summer temperatures remaining consistently high, cooling systems are a necessity rather than a luxury.

Additionally, Qatar’s growing population, which reached approximately 2.8 million in 2024, has led to increased housing and infrastructure projects, further driving the demand for air conditioning systems. The country’s ongoing urbanization and real estate boom have resulted in a surge in new residential and commercial buildings, all of which require cooling solutions. In 2024 alone, over 200,000 AC units were installed in residential properties, with an additional 40,000 units in new office buildings and retail spaces across Doha and other urban centers.

Changing Consumer Preferences and Product Trends

Consumers in Qatar are increasingly prioritizing energy-efficient air conditioning solutions. Split air conditioners dominate the market, accounting for approximately 80% of sales due to their energy efficiency, affordability, and suitability for various building types. Their ability to provide targeted cooling in individual rooms makes them a preferred choice for both homeowners and commercial establishments.

Ducted air conditioning systems are also gaining popularity, especially in luxury villas, hotels, and high-end commercial spaces. With Qatar’s continuous push toward sustainable infrastructure, inverter technology has gained widespread adoption. In 2024, sales of inverter AC units, known for their energy-saving capabilities, exceeded 80,000 units, marking a 30% increase from the previous year. These systems consume significantly less electricity while providing superior cooling, making them a favored option for environmentally conscious consumers and businesses alike.

Sustainability and Government Initiatives

Qatar’s Vision 2030 emphasizes sustainability and energy efficiency, driving a significant shift in the air conditioning industry toward greener alternatives. The government has introduced various initiatives to promote sustainable cooling solutions, including incentives for energy-efficient appliances and stricter regulations on refrigerants that contribute to climate change.

The adoption of green building standards has led to an increase in installations of solar-powered AC units, particularly in commercial buildings and government offices. By 2024, more than 15,000 solar-powered air conditioning units had been installed in Qatar, reflecting the growing emphasis on sustainable cooling solutions.

Expansion of the Hospitality and Commercial Sectors

The hospitality sector plays a crucial role in the growth of Qatar’s air conditioning market. As the country continues to position itself as a global tourism hub, new hotel projects and resorts are being developed to accommodate the influx of visitors. In 2024, the Qatari hospitality industry added 25,000 new hotel rooms, each equipped with advanced cooling systems to ensure guest comfort.

Similarly, the retail and commercial sector is experiencing rapid expansion. Qatar’s increasing number of shopping malls, office buildings, and entertainment complexes demand high-efficiency air conditioning systems. Large-scale developments such as the Mall of Qatar and Lusail City have incorporated centralized and smart cooling systems to enhance energy efficiency while providing optimal cooling solutions for visitors and tenants.

Material and Technological Innovations

The air conditioning industry in Qatar has seen advancements in materials and technology that enhance system performance and durability. Copper coils remain the preferred choice for AC units due to their superior heat conductivity and longer lifespan compared to aluminum alternatives. The increased demand for high-efficiency cooling solutions has also encouraged manufacturers to introduce air conditioners with advanced filtration systems, smart thermostats, and automated temperature controls.

Artificial intelligence (AI) and the Internet of Things (IoT) are playing an increasingly vital role in the air conditioning market. AI-driven AC units are designed to optimize cooling based on room occupancy, weather conditions, and user preferences, significantly reducing energy consumption. Smart air conditioners that can be controlled via mobile apps are becoming more common, offering consumers greater convenience and customization options.

Competitive Landscape

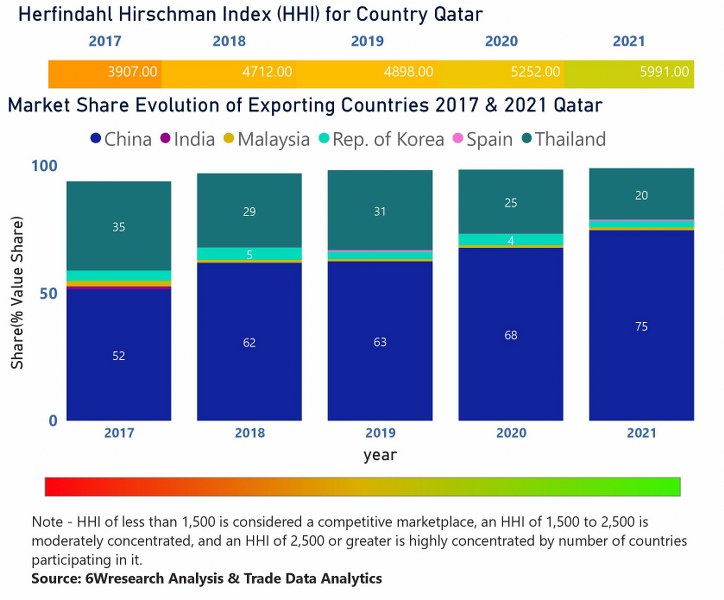

The Qatari air conditioner market is highly competitive, with leading global and regional players vying for market share. Major brands such as Daikin, LG, Samsung, and Mitsubishi Electric dominate the industry, offering a wide range of cooling solutions tailored to Qatar’s unique climate conditions. Daikin’s inverter ACs have emerged as top sellers, reflecting consumer preference for energy-efficient and reliable cooling solutions.

Local distributors and retailers also play a crucial role in shaping market trends. The availability of after-sales services, warranties, and financing options influences purchasing decisions among consumers and businesses alike. Many manufacturers are also expanding their local presence through service centers and partnerships with construction firms to meet the growing demand for customized air conditioning solutions in new developments.

Regional Market Comparisons

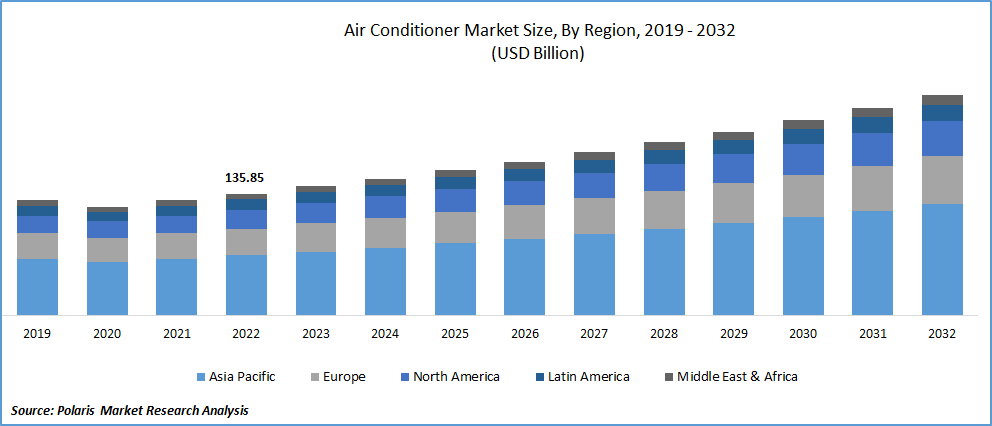

Qatar’s air conditioner market growth aligns with trends seen across the Gulf Cooperation Council (GCC) countries. Saudi Arabia’s air conditioner market, for instance, is projected to reach $5.97 billion by 2033, growing at a CAGR of 7.46% from 2025 to 2033. This regional trend underscores the increasing demand for air conditioning solutions across the Middle East, driven by extreme climate conditions and continued urban expansion.

The UAE and Kuwait are also witnessing similar growth, with an emphasis on smart and energy-efficient air conditioning systems. Governments in these countries have implemented regulations promoting eco-friendly refrigerants and energy-saving appliances, mirroring Qatar’s sustainability efforts.

Future Outlook and Market Opportunities

The future of Qatar’s air conditioner market looks promising, with significant opportunities for manufacturers, service providers, and retailers. As demand for energy-efficient and smart cooling solutions continues to rise, companies investing in innovation, sustainability, and after-sales services will be well-positioned to thrive.

The increasing penetration of AI and IoT in air conditioning systems will further drive market expansion. Consumers and businesses are expected to continue shifting toward smart, automated cooling solutions that offer energy savings and enhanced user experience. Government regulations and incentives promoting sustainability will also encourage greater adoption of eco-friendly air conditioning technologies.

In conclusion, Qatar’s air conditioner market is on a strong growth trajectory, driven by climatic necessities, population expansion, and a national commitment to sustainability. With rising demand for innovative cooling solutions, the industry is set to reach $626.60 million by 2033, presenting a lucrative opportunity for businesses and investors in the region.

Qatar’s Freshwater Fish Market: Analysis, Trends, and Future Forecast