In recent years, Qatar’s freshwater fish market has experienced fluctuations, reflecting a complex interplay of domestic production efforts, import dynamics, and shifting consumer preferences. Despite governmental initiatives aimed at bolstering local aquaculture, the market faced a significant downturn in 2023. However, there are promising signs for recovery as the industry adapts to new trends and technologies.

Market Size and Recent Decline

After two consecutive years of growth, 2023 saw a steep decline in the Qatari freshwater fish market, with the market value dropping by 61.8%, settling at approximately $775,000. This sharp downturn underscores the market’s volatility and highlights critical challenges that must be addressed to ensure sustainable growth.

Several factors contributed to this decline, including disruptions in the supply chain, shifts in consumer demand, and increasing competition from imported seafood. Additionally, local production struggles with issues such as water scarcity, high operational costs, and limited access to advanced aquaculture technology. The decline in demand for freshwater fish within the hospitality and retail sectors also played a role, as economic conditions and changing dietary preferences influenced consumer spending habits.

Despite these setbacks, Qatar remains committed to strengthening its freshwater fish market. The government has been implementing policies aimed at increasing local fish production, reducing dependence on imports, and investing in sustainable fish farming technologies.

Import Trends and Key Suppliers

Qatar continues to rely heavily on imported freshwater fish to meet local demand. Over the past decade, imports have played a significant role in shaping the country’s seafood market, with fresh and frozen fish products arriving from various countries. However, in 2023, Qatar saw a substantial reduction in import volumes.

Iran emerged as the primary supplier of freshwater fish to Qatar, accounting for a large share of imports. Other notable suppliers include Turkey, India, and Southeast Asian nations. The decrease in imports suggests a potential shift toward enhancing local aquaculture production or changing consumer preferences.

This shift presents opportunities for local fish farmers to expand their production and distribution networks. By increasing domestic supply, Qatar can reduce its reliance on foreign imports and establish a more self-sufficient seafood industry. However, this will require significant investments in infrastructure, research, and workforce development.

Government Initiatives and Aquaculture Development

The Qatari government has recognized the importance of aquaculture in ensuring long-term food security and economic stability. Several initiatives have been launched to support fish farming projects and promote sustainable practices.

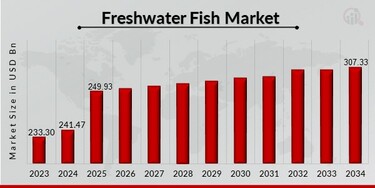

The Qatar Fisheries and Aquaculture Market is projected to reach $180.16 million in 2025, with expectations to grow at a compound annual growth rate (CAGR) of 5%, reaching $229.93 million by 2030. This growth will be driven by efforts to enhance local fish production, improve supply chain logistics, and adopt innovative farming techniques.

In recent years, Qatar has invested heavily in research and development to improve fish breeding, disease management, and feed quality. Programs have also been introduced to train local farmers and encourage young entrepreneurs to enter the aquaculture industry.

One key government-backed initiative is the introduction of aquaponics and recirculating aquaculture systems (RAS). These advanced systems allow for more efficient fish farming by reducing water usage and improving overall production capacity. By integrating technology into traditional aquaculture methods, Qatar aims to enhance sustainability while meeting growing consumer demand.

Technological Advancements and Sustainable Practices

The adoption of advanced aquaculture technologies has played a crucial role in transforming Qatar’s freshwater fish market. Innovations such as smart water monitoring, automated feeding systems, and bio-secure fish farms have helped improve productivity while minimizing environmental impact.

Sustainable fish farming practices are also gaining traction, with more emphasis being placed on eco-friendly production methods. Recirculating aquaculture systems (RAS) have proven to be a game-changer for Qatar’s aquaculture industry, as they allow fish to be farmed in controlled environments with minimal water waste.

By focusing on sustainability, Qatar is positioning itself as a leader in environmentally responsible aquaculture. Government agencies and private sector investors are working together to establish best practices and create a long-term vision for the industry’s future.

Market Concentration and Competitive Landscape

The Qatari freshwater fish market has become increasingly concentrated over the years, with a few major players dominating the industry. The Herfindahl-Hirschman Index (HHI), which measures market concentration, rose from 2,219 in 2017 to 3,393 in 2023, indicating that a small number of firms now control a significant portion of the market.

While market concentration can lead to stability and investment in high-quality production, it also presents challenges for smaller fish farmers. The dominance of larger players can make it difficult for new entrants to compete, especially when it comes to securing distribution channels and gaining access to advanced technology.

To foster a more competitive market, the government is encouraging collaboration between small-scale fish farmers and larger aquaculture companies. Cooperative models and financial incentives are being explored to support the growth of small and medium-sized enterprises (SMEs) in the sector.

Future Projections and Growth Opportunities

Despite recent setbacks, the outlook for Qatar’s freshwater fish market remains promising. The fish and seafood market in Qatar is projected to reach $196.80 million by 2025, with an anticipated annual growth rate of 8.28% from 2025 to 2029. Several factors will drive this growth, including increased consumer awareness about the benefits of locally sourced fish, technological advancements in fish farming, and continued government support for the aquaculture sector.

One of the key opportunities for market growth lies in diversifying fish species and expanding aquaculture infrastructure. Introducing high-value fish species that are well-suited to Qatar’s climate can help boost local production and attract a wider range of consumers. Additionally, enhancing supply chain efficiencies, such as improving cold storage and transportation networks, will be crucial in meeting growing market demands.

Another area of potential growth is the expansion of value-added fish products, such as smoked, marinated, and ready-to-cook fish items. With the increasing popularity of convenience foods, businesses that can offer high-quality, processed fish products are likely to see significant success in the coming years.

Conclusion

Qatar’s freshwater fish market is at a critical juncture, balancing between overcoming recent setbacks and capitalizing on future growth prospects. The government’s commitment to boosting local aquaculture, coupled with technological innovations and sustainable practices, is paving the way for a more resilient seafood industry.

To ensure long-term success, stakeholders across the supply chain must collaborate to address challenges such as market concentration, high production costs, and changing consumer preferences. With the right investments and strategic planning, Qatar has the potential to transform its freshwater fish market into a thriving and sustainable sector that contributes to national food security and economic prosperity.

As Qatar continues to navigate the evolving landscape of the seafood industry, adaptability and innovation will be key drivers of success. By fostering a more self-sufficient and competitive market, the country can achieve its goal of becoming a leading player in the global aquaculture industry.

Couple Seated Next to Deceased Passenger for Hours on Qatar Airways Flight