Artificial Intelligence (AI) has become one of the most transformative forces across the world, and Kuwait is no exception. In recent years, Kuwait’s financial sector has been actively adopting AI-driven tools and solutions to make smarter, faster, and more accurate investment decisions. From improving portfolio management to enhancing risk assessment, AI is enabling investors, financial institutions, and even individuals in Kuwait to shape their financial futures with more confidence and precision.

Kuwait, with its growing appetite for innovation and technology, is witnessing a shift in how investments are being approached. Gone are the days when investment decisions were solely based on human instinct and traditional market analysis. Today, AI is creating a bridge between data and decision-making, allowing Kuwaiti investors to maximize opportunities while minimizing risks.

AI and the Changing Financial Landscape in Kuwait

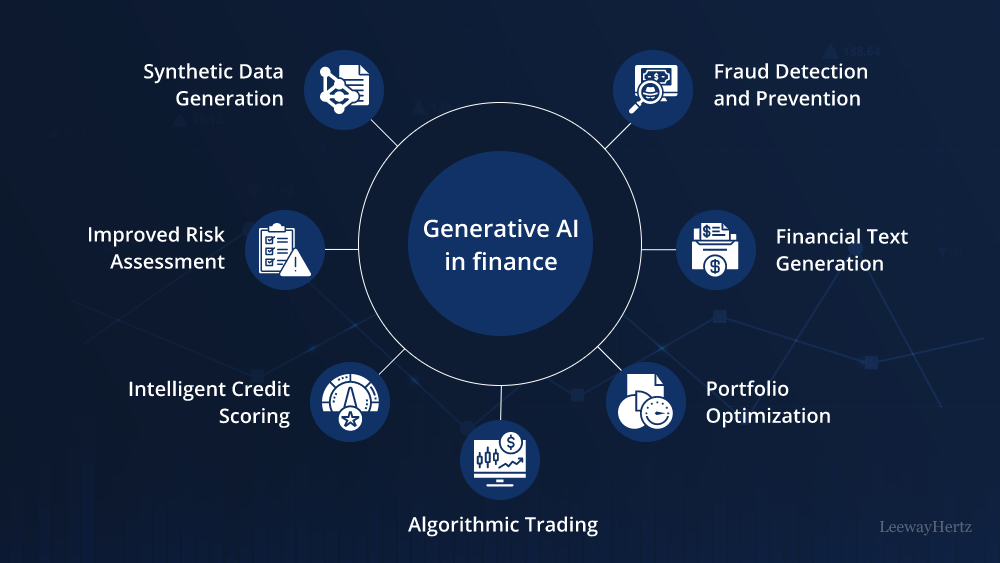

The financial market in Kuwait has historically relied on traditional investment practices. While human expertise remains valuable, the sheer volume of financial data in today’s world is overwhelming. AI is solving this challenge by analyzing massive datasets at incredible speed, something humans alone cannot achieve.

Financial institutions in Kuwait now use AI algorithms to detect market patterns, study historical performance, and predict potential investment outcomes. This doesn’t replace human judgment but enhances it, offering investors a sharper and more accurate picture of the market.

Smarter Risk Management

Investment always involves risk, but AI is helping Kuwait’s investors manage it in new and innovative ways. Traditional methods of risk management often relied on historical data and forecasts, which had limitations. Today, AI integrates real-time data, news, social trends, and even geopolitical factors to assess risks more dynamically.

For instance, AI systems can detect early warning signs of market downturns or sudden changes in commodity prices, which is especially important for Kuwait, given its oil-dependent economy. By predicting risks before they become visible to the public eye, investors can make better-informed decisions, protecting their wealth and securing long-term returns.

Artificial Intelligence : Personalised Investment Strategies

One of the most exciting applications of AI in Kuwait’s financial sector is the development of personalised investment strategies. Investors no longer need to rely on one-size-fits-all portfolios. AI-powered platforms can analyse an individual’s financial history, goals, risk tolerance, and spending habits to create tailor-made investment plans.

This is especially appealing to younger Kuwaitis who are increasingly interested in exploring financial markets beyond oil. With AI, even new investors can receive expert-level guidance, making wealth-building more accessible and achievable.

The Role of Robo-Advisors in Kuwait

Robo-advisors are AI-driven digital platforms that provide automated financial planning services. In Kuwait, these platforms are gaining popularity as they allow individuals to start investing with lower costs compared to traditional financial advisors.

Robo-advisors can manage portfolios, rebalance assets, and even adjust strategies automatically when the market shifts. For Kuwaitis looking for simple, cost-effective, and efficient investment management, robo-advisors represent the future. They also empower individuals who may not have deep financial knowledge to confidently participate in investment opportunities.

AI in Stock Market Predictions

The Kuwaiti stock exchange is also benefiting from AI’s predictive power. Machine learning models can process years of trading data and current market trends to forecast stock price movements with greater accuracy. This doesn’t guarantee success, but it gives investors a stronger edge in identifying profitable opportunities.

AI’s ability to process global economic signals, such as oil demand, foreign investments, and currency fluctuations, makes it particularly useful in Kuwait’s interconnected financial environment. Investors who integrate AI-based insights into their strategies often gain a competitive advantage.

Enhancing Customer Experience in Banking

AI is not just shaping investment strategies but also improving how banks and financial institutions in Kuwait interact with customers. Chatbots, virtual assistants, and AI-powered customer service platforms are offering 24/7 support, providing investment advice, and answering customer queries instantly.

This seamless experience not only builds trust but also encourages more Kuwaitis to explore investment opportunities. Financial institutions that adopt AI-driven services are more likely to engage and retain customers in the long term.

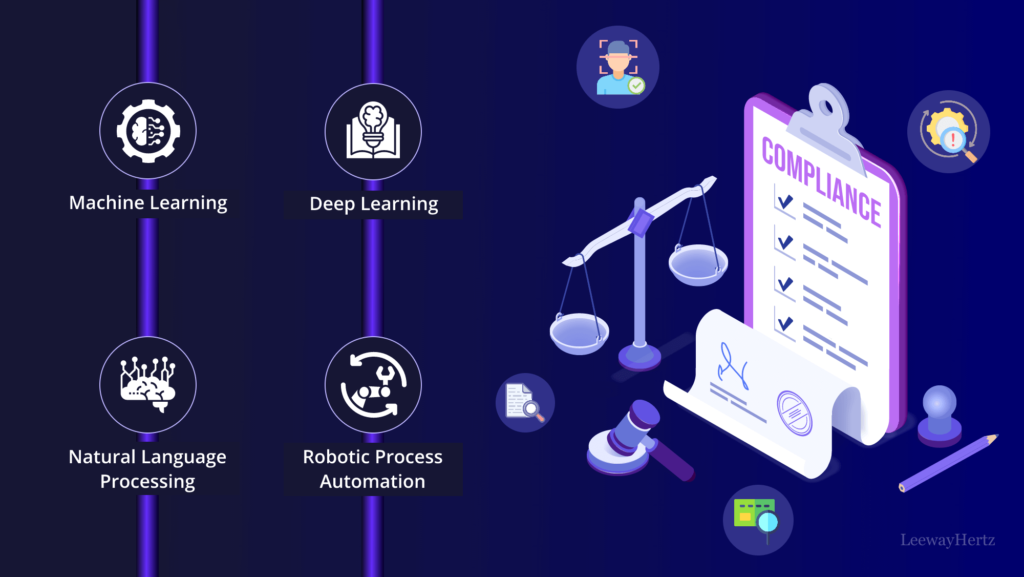

AI and Islamic Finance

Kuwait, being a hub of Islamic finance, has a unique opportunity to integrate AI into Sharia-compliant investment practices. AI can help ensure compliance by automatically screening potential investments based on Islamic financial principles. This reduces the complexity for investors who want to follow Sharia guidelines while still accessing a wide range of financial opportunities.

The use of AI in Islamic finance is expected to open new doors for innovation, attracting more local and international investors to Kuwait’s financial ecosystem.

Training the Next Generation of Investors

Kuwait’s young and tech-savvy population is particularly well-positioned to embrace AI in financial decision-making. Universities, training institutes, and financial organizations are increasingly offering courses and workshops on AI and its role in investments.

By educating the next generation of investors, Kuwait is preparing for a future where technology and finance go hand in hand. This will not only diversify the economy but also reduce over-reliance on oil revenues.

Building Investor Confidence

Trust plays a huge role in investment, and AI is strengthening that trust in Kuwait. By providing accurate predictions, transparent insights, and real-time analysis, AI makes the investment process clearer and more reliable. Investors who once hesitated due to lack of knowledge or fear of loss are now more willing to step into the financial market with AI-guided support.

This confidence also benefits the economy at large, as more participation in investments leads to stronger financial growth and diversification.

Challenges and Considerations

While the impact of AI on investment in Kuwait is largely positive, it also comes with challenges. Dependence on AI without human oversight could lead to mistakes, especially if the algorithms are not properly trained. Cybersecurity is another concern, as financial data must be protected from threats and breaches.

Additionally, not all investors are equally comfortable with technology. Some may prefer traditional methods, and bridging this gap will require education and trust-building efforts. Despite these challenges, the benefits of AI in Kuwait’s financial sector far outweigh the risks.

The Future of AI in Kuwait’s Financial Sector

Looking ahead, the role of AI in Kuwait’s investment decisions is only expected to grow. With advancements in technology, AI tools will become even more sophisticated, offering deeper insights, stronger predictive models, and more personalised experiences.

Kuwait’s government and private sector are also showing interest in adopting digital transformation strategies, which means more support for AI-driven finance initiatives. This will likely attract foreign investors, boost economic diversification, and position Kuwait as a leader in AI-powered finance in the region.

Conclusion

AI is no longer a futuristic concept it is a reality shaping Kuwait’s financial investment decisions today. From managing risks and creating personalised strategies to enhancing Islamic finance and training future investors, AI is transforming the way Kuwait approaches wealth and growth.

The journey is just beginning, but the direction is clear: AI will continue to empower Kuwaitis with smarter, faster, and more confident investment opportunities. As technology evolves, Kuwait’s financial sector will not only grow but also inspire the world with its innovative approach to combining tradition and modernity through AI.

Also Read – Digital Leap: Kuwait Embraces E-Signatures in Governance