The S&P PMI Index UAE data for 2025 has revealed encouraging signs of continued economic growth in the country’s non-oil private sector. According to the latest release from S&P Global, the S&P PMI Index UAE remained firmly in expansion territory, pointing to strong business activity, improving demand conditions, and rising optimism among firms.

Let’s break down what the S&P PMI Index UAE says and what it means for the UAE’s economic direction in 2025.

What Is the S&P PMI Index?

Understanding the PMI

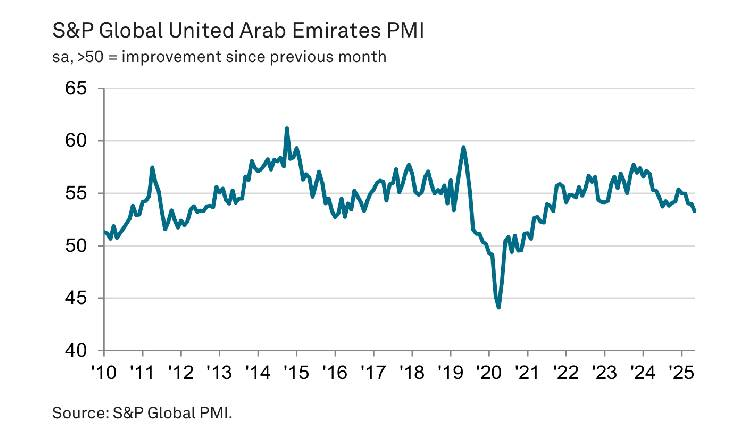

The S&P PMI Index UAE is a key economic indicator measuring the health of the non-oil private sector, including services, construction, and manufacturing industries. A PMI value above 50 indicates expansion, while anything below signals contraction.

Published monthly by S&P Global, the S&P PMI Index UAE tracks vital business metrics such as new orders, employment, supplier delivery times, and output. It’s widely used by policymakers, investors, and analysts to gauge the economic pulse of the country.

Key Findings From the Latest S&P PMI UAE Report

1. Index Stays Above the Expansion Threshold

The most recent S&P PMI Index UAE posted a score of 55.3, showing sustained expansion across the UAE’s non-oil sectors. While slightly down from earlier peaks, this level is well above the neutral 50-point mark and reflects consistent business momentum.

2. Surge in New Orders and Client Demand

Surveyed companies in the S&P PMI Index UAE reported a marked rise in new orders, driven by stronger domestic demand and a revival in exports. Respondents linked these gains to competitive pricing strategies and improved consumer confidence ahead of the summer season.

This increase in new business indicates that consumer spending and demand resilience continue to fuel the non-oil sector.

3. Output Growth Accelerates

A key highlight of the S&P PMI Index UAE is the acceleration in output levels. As firms received more client orders, they expanded production to meet rising market needs. Sectors like retail, tourism, and construction were major contributors to this growth.

This points to increasing efficiency and operational scaling among UAE-based businesses.

4. Business Optimism Hits 10-Month High

The S&P PMI Index UAE also captured a sharp rise in business confidence. The index shows expectations for future output hitting a 10-month high, suggesting that companies are optimistic about upcoming projects, favorable policy support, and a strengthening economy.

Employment and Inventories Show Mixed Trends

While business activity and new orders showed strong growth, employment levels saw only marginal changes. Some firms reported hiring to meet rising workloads, but overall job creation remained subdued.

Stock levels of purchases also rose slightly as companies built up inventories to prepare for future demand. However, input cost inflation was modest, helping to maintain stable selling prices.

Sector-Wise Growth Patterns

Services Lead the Expansion

According to the S&P PMI Index UAE, the services sector—including retail, tourism, and financial services—led overall expansion. A rise in domestic activities and tourism contributed to a surge in demand for hospitality and customer-facing services.

Construction and Real Estate Stay Resilient

Construction also showed resilience in the S&P PMI Index UAE report. Key infrastructure and housing developments in Abu Dhabi and Dubai are helping maintain confidence. Real estate activity remained active, supported by local and foreign investors.

What Does This Mean for the UAE Economy?

The S&P PMI Index UAE continues to reflect the country’s efforts to diversify its economy away from oil. Growth in the non-oil private sector underlines the effectiveness of national strategies such as UAE Vision 2031 and targeted free zone development.

Analysts following the S&P PMI Index UAE expect this trend to hold, supported by international investment, stable regulations, and regional economic partnerships.

Economic Challenges to Watch

Despite the positive outlook, the UAE economy still faces some challenges:

- Global inflationary pressures could affect import prices.

- Geopolitical instability in some regions may impact investor sentiment.

- Interest rate fluctuations could affect borrowing costs and investment plans.

However, so far, the UAE’s policy framework and financial buffers have helped mitigate these risks effectively.

Conclusion: A Promising Outlook

The S&P PMI Index UAE for 2025 presents a strong narrative of business resilience and economic adaptability. With a solid PMI score, increased orders, and renewed business optimism, the UAE is poised for continued non-oil sector growth.

For business leaders, investors, and entrepreneurs, the S&P PMI Index UAE offers valuable insights. If current trends continue, the UAE could outperform many of its peers in economic growth and private sector performance in the coming months.

Read More- Big Ticket Winner Bags Dhs20M in Abu Dhabi Jackpot Draw